Rosemary's capital gains and losses in recent years (and the annual exemption for each year) have been

Question:

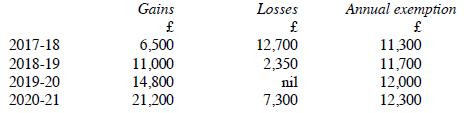

Rosemary's capital gains and losses in recent years (and the annual exemption for each year) have been as follows:

There were no unrelieved losses to bring forward from 2016-17 or earlier. Compute her taxable gains for tax years 2017-18 to 2020-21 inclusive.

Transcribed Image Text:

2017-18 2018-19 2019-20 2020-21 Gains 6,500 11,000 14,800 21,200 Losses 12,700 2,350 nil 7,300 Annual exemption 11,300 11,700 12,000 12,300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

To compute Rosemarys taxable gains for the tax years 201718 to 202021 we need to take into account h...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Rosemary's capital gains and losses in recent years (and the annual exemption for each year) have been as follows: There were no unrelieved losses to bring forward from 2013 -14 or earlier. Compute...

-

Rosemary's capital gains and losses in recent years (and the annual exemption for each year) have been as follows: There were no unrelieved losses to bring forward from 2017-18 or earlier. Compute...

-

Rosemary's capital gains and losses in recent years (and the annual exemption for each year) have been as follows: Gains Losses Annual exemption 2014-15 6,500 12,700 11,000 2015-16 10,400 2,350...

-

Arginine, the most basic of the 20 common amino acids, contains a guanidino functional group in its side chain. Explain, using resonance structures to show how the protonated guanidino group...

-

Frank Corporation manufactures a single product that has a selling price of $25.00 per unit. Fixed expenses total $64,000 per year, and the company must sell 8,000 units to break even. If the company...

-

The initial values for the state probabilities a. are always greater than the equilibrium state probabilities. b. are always less than the equilibrium state probabilities. c. do not influence the...

-

16-9. Cules son las dos dimensiones de la matriz de posicionamiento detallista ?

-

For Everly Company, units to be produced are 5,000 in quarter 1 and 6,000 in quarter 2. It takes 1.5 hours to make a finished unit, and the expected hourly wage rate is $14 per hour. Prepare a direct...

-

ANSWER ALL THE QUESTIONS (100 marks) Q1. Explain the elements of value creation between the buyer-seller relationships and salesperson's behaviour, motivation and role perceptions significance to the...

-

In 2020-21, Ahmed has capital gains of 130,000 and allowable losses of 24,000. He also has capital losses brought forward of 3,700. Ahmed's taxable income for 2020-21 (after deduction of the personal...

-

On what date is CGT for 2020-21 normally due for payment?

-

Give examples of two activities that courts have classified as not being abnormally dangerous and explain why they were not considered to be so.

-

Nequired information Exercise 5-17 (Static) Notes receivable-interest accrual and collection LO 5-6 (The following information applies to the questions displayed below) Agrico Incorporated accepted...

-

Case 14-3 Sarin Pharmaceuticals Ltd. Alan Mannik, director of procurement for the Sarin Phar- maceuticals Ltd. (Sarin) Animal Health Division plant in Vancouver, British Columbia, was planning for...

-

CL727 LEGAL ANALYSIS AND WRITING Module 11 Assignment: Brief Answer, Analysis, and Conclusion This assignment will be due in Module 11. Your assignment is to write the Brief Answer, Analysis, and...

-

Question 11 (0.5 points) l) Listen } As a drug manufacturer, you expect your latest wonder drug to lower cholesterol. It has been successful with a limited group of participants so far, so you have...

-

Redfern Audio produces audio equipment including headphones. At the Campus Facility, it produces two wireless models, Standard and Enhanced, which differ both in the materials and components used and...

-

Provide specific examples of the advantages of WiMAX compared to wire line communications.

-

Velshi Printers has contracts to complete weekly supplements required by fortysix customers. For the year 2018, manufacturing overhead cost estimates total $600,000 for an annual production capacity...

-

Prance, in Problem 12, reports $600,000 of pretax book net income in 2015. Prances book depreciation exceeds tax depreciation in this year by $20,000. Prance reports no other temporary or permanent...

-

Mini, Inc., earns pretax book net income of $750,000 in 2014. Mini deducted $20,000 in bad debt expense for book purposes. This expense is not yet deductible for tax purposes. Mini records no other...

-

Mini, in Problem 16, reports $800,000 of pretax book net income in 2015. Mini did not deduct any bad debt expense for book purposes but did deduct $15,000 in bad debt expense for tax purposes. Mini...

-

The following is part of the computer output from a regression of monthly returns on Waterworks stock against the S&P 5 0 0 index. A hedge fund manager believes that Waterworks is underpriced, with...

-

Doisneau 25-year bonds have an annual coupon interest of 8 percent, make interest payments on a semiannual basis, and have a $1,000 par value. If the bonds are trading with a market's required yield...

-

Hite corporation intends to issue $160,000 of 5% convertible bonds with a conversion price of $40 per share. The company has 40,000 shares of common stock outstanding and expects to earn $600,000...

Study smarter with the SolutionInn App