Sarah dies on 16 December 2017 , having made net capital losses of 7,300 between 6 April

Question:

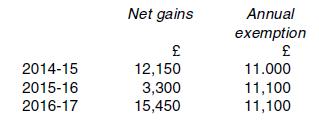

Sarah dies on 16 December 2017 , having made net capital losses of £7,300 between 6 April 2017 and the date of her death. Her net gains in the previous three years (and the annual exemption for each of those years) were as follows:

Calculate her taxable gains for 2014-15 to 2017-18 inclusive.

Transcribed Image Text:

2014-15 2015-16 2016-17 Net gains 12,150 3,300 15,450 Annual exemption 11.000 11,100 11,100

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

Since losses in the year of death are carried back to the most recent y ear first it is easier to be...View the full answer

Answered By

Divya Munir

I hold M.Sc and M.Phil degrees in mathematics from CCS University, India and also have a MS degree in information management from Asian institute of technology, Bangkok, Thailand. I have worked at a international school in Bangkok as a IT teacher. Presently, I am working from home as a online Math/Statistics tutor. I have more than 10 years of online tutoring experience. My students have always excelled in their studies.

4.90+

0 Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Read the case study "Southwest Airlines," found in Part 2 of your textbook. Review the "Guide to Case Analysis" found on pp. CA1 - CA11 of your textbook. (This guide follows the last case in the...

-

The following list shows the top six pharmaceutical companies in the United States and their sales figures ($ millions) for a recent year. Use this information to construct a pie chart and a bar...

-

Determine the probability mass function for the random variable with the following cumulative distribution function

-

Could ritual have been, in any way, helpfully reduced? L01

-

1. Explain how long-term price-to-earnings (P/E) ratios in the U.S. stockmarket of around 15 times are consistentwith long-term expected stock returns of around 6 to 7 percent a year in real terms.

-

In the audit of accounts receivable, auditors develop specific audit assertions related to the receivables. They then design specific substantive procedures to obtain evidence about each of these...

-

Question-3: Wayne Inc is fast growing manufacturer of film rolls. Direct materials are added at the start of the production process. Cewersion costs are added evenly during the process some units of...

-

In 2017-18, an individual has capital gains of 263,000 and allowable losses of 12,000. He has no unrelieved capital losses brought forward from previous ye ars. His taxable income for 2017-18 (after...

-

Three taxpayers each have 3,000 of capital losses brought forward. Calculate their taxable gains for 2017-18 if their total gains and losses for the year are as follows: (a) Taxpayer A has gains of...

-

In Exercises 3952, a. Find an equation for f -1 (x). b. Graph f and f -1 in the same rectangular coordinate system. c. Use interval notation to give the domain and the range of f and f -1 . f(x) = x...

-

What is the length of the partial wavelength for electromagnetic energy with a frequency of 15 MHz and a phase shift of 263 degrees (in meters)?

-

Let y = f(x) be a function that is differentiable at all real numbers. Suppose f has the form f(x) = {; [cx +6 4+2c for x 1 for x > 1. where b and c are some constants. What is the value of the...

-

Consider the sequence (n) defined by xn = (a) Show that 0In - n! nn (b) Use the result of part (a) and the Squeeze theorem to show that In 0 and n o.

-

Officials of Gwinnett County, one of the fastest growing counties in the country, are looking for ways to expand their sewer system. They are considering two alternative sewer designs. All annual...

-

On August 1, 20Y7, Rafael Masey established Planet Realty, which completed the following transactions during the month: Rafael Masey transferred cash from a personal bank account to an account to be...

-

Discuss how profit is defined.

-

As you rewrite these sentences, replace the cliches and buzzwords with plain language (if you don't recognize any of these terms, you can find definitions online): a. Being a jack-of-all-trades, Dave...

-

Sandra acquired the following ordinary shares in Pincer plc: On 26 June 2020, Sandra sold 700 of her shares in Pincer plc. Assuming that she acquired no further shares in the company during 2020,...

-

A taxpayer makes the following acquisitions of preference shares in Muvex Ltd: No further shares are acquired during 2020 or 2021. How will the following disposals be matched against these...

-

In June 2015, Darren bought 1,000 ordinary shares in Cubson plc for 8,400. In November 2020, Phere plc made a takeover bid for Cubson plc, offering two ordinary shares and one preference share in...

-

Series of Compound Interest Techniques The following are several situations involving compound interest. Required: Using the appropriate table, solve each of the following: ( Click here to access the...

-

If Clark Kelly has recognized gain on an exchange of like-kind property held for investment use, where does Clark report the gain? First on Form 8824, then carried to Schedule D. First on Form 8824,...

-

An investor put 40% of her money in Stock A and 60% in Stock B. Stock A has a beta of 1.2 and Stock B has a beta of 1.6. If the risk-free rate is 5% and the expected return on the market is 12%,...

Study smarter with the SolutionInn App