Tina made the following acquisitions of ordinary shares in Hombus plc: On 1 June 2016, the company

Question:

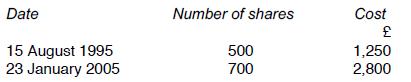

Tina made the following acquisitions of ordinary shares in Hombus plc:

On 1 June 2016, the company made a 1 for 20 rights issue at £8 per share and Tina decided to buy the shares to which she was entitled. Calculate the chargeable gain arising on 12 November 2020 when Tine sold 840 shares for £7 each, assuming that she made no further acquisitions within the next 30 days.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: