Tony died on 11 July 2020, leaving an estate which was valued at 900,000. None of the

Question:

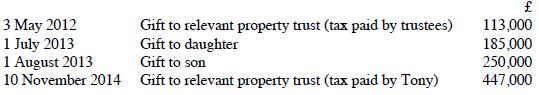

Tony died on 11 July 2020, leaving an estate which was valued at £900,000. None of the transfers made on his death were exempt from IHT. He had made the following transfers during his lifetime:

Calculate the tax payable as a result of Tony's death. (Assume that there is no unused nilrate band to be transferred from a previously deceased spouse or civil partner and that Tony's residence was not left to a direct descendant).

Transcribed Image Text:

3 May 2012 1 July 2013 1 August 2013 10 November 2014 Gift to relevant property trust (tax paid by trustees) Gift to daughter Gift to son Gift to relevant property trust (tax paid by Tony) 113,000 185,000 250,000 447,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (2 reviews)

To calculate the inheritance tax IHT payable as a result of Tonys death we need to determine the value of his estate for IHT purposes and apply the ap...View the full answer

Answered By

JAPHETH KOGEI

Hi there. I'm here to assist you to score the highest marks on your assignments and homework. My areas of specialisation are:

Auditing, Financial Accounting, Macroeconomics, Monetary-economics, Business-administration, Advanced-accounting, Corporate Finance, Professional-accounting-ethics, Corporate governance, Financial-risk-analysis, Financial-budgeting, Corporate-social-responsibility, Statistics, Business management, logic, Critical thinking,

So, I look forward to helping you solve your academic problem.

I enjoy teaching and tutoring university and high school students. During my free time, I also read books on motivation, leadership, comedy, emotional intelligence, critical thinking, nature, human nature, innovation, persuasion, performance, negotiations, goals, power, time management, wealth, debates, sales, and finance. Additionally, I am a panellist on an FM radio program on Sunday mornings where we discuss current affairs.

I travel three times a year either to the USA, Europe and around Africa.

As a university student in the USA, I enjoyed interacting with people from different cultures and ethnic groups. Together with friends, we travelled widely in the USA and in Europe (UK, France, Denmark, Germany, Turkey, etc).

So, I look forward to tutoring you. I believe that it will be exciting to meet them.

3.00+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Tony died on 11 July 2021, leaving an estate which was valued at 900,000. None of the transfers made on his death were exempt from IHT. He had made the following transfers during his lifetime:...

-

Tony died on 11 July 2017, leaving an estate valued at 9 00,000. None of the transfers made on his death were exempt from IHT. He had made the following transfers during his lifetime: 3 May 2009 1...

-

ACME Company manufactures televisions. The company estimated there will be 4 7 , 7 0 0 units in inventory at the beginning of December 2 0 1 9 . ACME wants to have half of that amount in its...

-

a) The sustainable yield (Y) of a fishery is Y = E-0.5E where E denotes fishing effort. If the cost per unit of effort is 0.5 and the price of fish is 1, what is sustainable yield (i) under open...

-

Helmut purchases 100 shares of stock in Caisson Corporation for $1,000 in year 1. On December 1 of year 2, he purchases an additional 100 shares in the company for $1,500. On December 28 of year 2,...

-

Question highlighted page 331...

-

1. Exhibit 9.18 presents the income statement and balance sheet for Companies A, B, and C. Compute each companys return on assets (ROA), return on equity (ROE), and return on invested capital (ROIC)....

-

From the household budget survey of 1980 of the Dutch Central Bureau of Statistics, J. S. Cramer obtained the following logit model based on a sample of 2,820 households. (The results given here are...

-

Culver Company sponsors a defined benefit pension plan for its employees. The following data relate to the operation of the plan for the year 2020 in which no benefits were paid. 1. The actuarial...

-

Peter has had a home in the UK for many years and has always been UK resident. He has worked in the UK throughout his adult life but he retired in December 2019. During tax year 2020-21 he takes a...

-

On 12 November 2010, Hazel made a gross chargeable transfer to a relevant property trust of 266,000 (after deduction of exemptions). On 1 April 2016 she gave 300,000 to her grandson. These were her...

-

Economy Forms Corp. sold concrete-forming equipment to Kandy. After using the equipment for more than six months, Kandy notified Economy that the equipment was inadequate. Economy Forms alleged that...

-

Use Table 19-4 to calculate the building, contents, and total property insurance premiums for the policy (in $). Area Structural Rating Class Building Value 4 B $86,000 $ Building Premium Contents...

-

What are some reasons why leadership theory has evolved? Which theory of leadership is most applicable to today's organizations? Identify a leader that you admire and answer the following: What makes...

-

Identifying one major OSHA standard and one EPA law that are important to aviation and discussing how each has improved aviation safety

-

What is network optimization and what are some of the best practices that are used in the industry to optimize networks? Also, why is network documentation important and what are the security...

-

Demonstrate your understanding of data types by examining a public dataset and identifying the NOIR analytical data types of each of the data field (variables). This skill will be used frequently in...

-

In awarding the construction contracts for the new Freedom Tower in New York City, the city contracted with your company to provide a specialized welding service for the steel girders for this...

-

In the circuit shown in Figure 4, a battery supplies a constant voltage of 40 V, the inductance is 2 H, the resistance is 10, and l(0) = 0. (a) Find l(t). (b) Find the current after 0.1s.

-

Maul, Inc., a calendar year S corporation, incurred the following items. Tax-exempt interest income ............. $ 7,000 Sales ....................... 140,000 Depreciation recapture income...

-

Zebra, Inc., a calendar year S corporation, incurred the following items this year. Sammy is a 40% Zebra shareholder throughout the year. Operating income ............... $100,000 Cost of goods sold...

-

Spence, Inc., a calendar year S corporation, generates an ordinary loss of $110,000 and makes a distribution of $140,000 to its sole shareholder, Storm Nelson. Nelson's stock basis at the beginning...

-

Docs Auto Body has budgeted the costs of the following repair time and parts activities for 2009: Doc's budgets 6,000 hours of repair time in 2009. A profit margin of $7 per labour hour will be added...

-

QUESTION 28 In a perpetual inventory system, the cost of inventory sold is: Debited to accounts receivable. Debited to cost of goods sold. O Not recorded at the time goods are sold. O Credited to...

-

The following financial statements and additional information are reported. IKIBAN INC. Comparative Balance Sheets June 30, 2019 and 2018 2019 2018 $105,709 69,500 66,800 4,700 246,700 127,eee...

Study smarter with the SolutionInn App