You are a trainee chartered certified accountant and your manager has asked you for your help with

Question:

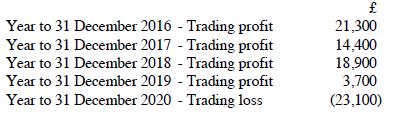

You are a trainee chartered certified accountant and your manager has asked you for your help with regard to a taxpayer who has made trading losses. Sean has been in self-employment since 2010, but ceased trading on 31 December 2020. He has always prepared accounts to 31 December and he is not a Scottish taxpayer. His results for the final five years of trading were as follows:

For each of the tax years 2016-17 to 2020-21, Sean has property business profits of £13,000. Sean has unused overlap profits brought forward of £4,600.

Required:

Identify the loss relief claims that are available to Sean and explain which of these claims would be the most beneficial. You should clearly state the amount of any reliefs claimed and the rates of income tax saved. However, you are not expected to compute any income tax liabilities. Assume for the sake of simplicity that income tax rates, bands and allowances for all years are the same as in 2020-21.

Step by Step Answer: