Donna, a single individual with no dependents, reports AGI of $100,000. She also reports the following itemized

Question:

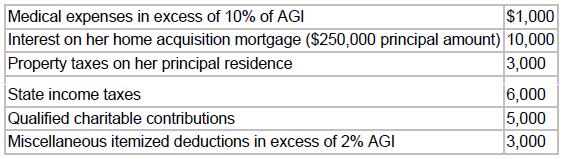

Donna, a single individual with no dependents, reports AGI of $100,000. She also reports the following itemized deductions:

What are Donna’s allowable deductions for her alternative minimum taxable income (AMTI)?

a. $10,000

b. $16,000

c. $18,000

d. $28,000

Transcribed Image Text:

Medical expenses in excess of 10% of AGI $1,000 Interest on her home acquisition mortgage ($250,000 principal amount) 10,000 Property taxes on her principal residence 3,000 State income taxes 6,000 Qualified charitable contributions 5,000 Miscellaneous itemized deductions in excess of 2% AGI 3,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 66% (3 reviews)

b 16000 Only the medical expenses mo...View the full answer

Answered By

Shadrack Mulunga

I am a Biochemistry by profession. However, I have explored different fields of study. My quest to explore new fields has helped me gain new knowledge and skills in Business, clinical psychology, sociology, organizational behavior and general management, and Project Management. I count my expertise in Project management, in particular, creation of Work Break Down Structure (WBS) and use of Microsoft Project software as one of my greatest achievement in Freelancing industry. I have helped thousands of BSC and MSC students to complete their projects on time and cost-effectively using the MS Project tool. Generally, I find happiness in translating my knowledge and expertise to success of my clients. So far, i have helped thousands of students to not only complete their projects in time but also receive high grades in their respective courses. Quality and timely delivery are the two key aspects that define my work. All those who hired my services always come back for my service. If you hire my services today, you will surely return for more. Try me today!

5.00+

154+ Reviews

289+ Question Solved

Related Book For

Taxation For Decision Makers 2018

ISBN: 9781119373735

8th Edition

Authors: Shirley Dennis Escoffier, Karen Fortin

Question Posted:

Students also viewed these Business questions

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

Donna, a single individual with no dependents, reports AGI of $100,000. She also reports the following itemized deductions: Medical expenses ($11,000 total 7.5% of AGI)...

-

Question: Old MathJax webview Old MathJax webview i need ans of these question but the source is alot Old MathJax webviewOld MathJax webview i need ans of these question but the source is alot these...

-

What is data science, how does it differ from traditional statistics, explain data science process, including the key steps involve in it.

-

In Figure 9.2, identify the market and optimal outcomes. Does the market under or overproduce public goods? FIGURE 9.2 M (market outcome) X (optimal outcome) Markets underproduce public goods. PUBLIC...

-

The recognition that an organisation is distinct from its owners is a fair description of which concept? (a) duality (b) separate valuation (c) business entity (d) objectivity

-

12-5. Hertz cre su ventaja diferencial en los puntos de __________ en su auditora de contacto con el consumidor.

-

Data on the average size of a soda (in ounces) at all 30 major league baseball parks are as follows: 14, 18, 20, 16, 16, 12, 14, 16, 14, 16, 16, 16, 14, 32, 16, 20, 12, 16, 20, 12, 16, 16, 24, 16,...

-

B. The stock flow below is shown in Syarikat Jayaria Bhd. Stock card for the month of August 2018 Sales (Units) Date Purchases Units RM/Unit 10 10.00 Aug 2 = 15.00 11.00 14.50 Sales price is RM26 per...

-

Harry and Silvia, a married couple, are both age 67 and legally blind. What is their standard deduction for 2017?

-

Lynn and Dave, a married couple with a dependent child age 16, have AGI of $300,000 in 2017 and report the following itemized deductions before deducting any floors that may apply: What is their...

-

Assume that you have just sequenced a small fragment of DNA that you had cloned. The nucleotide sequence of this segment of DNA is as follows....

-

Based on the expense information below how do I figure out the break even, total fixed costs, total income for each procedure, variable costs dependent upon volume? The organization is purchasing a...

-

Compare training formats. Do you personally prefer classroom training, small group sessions, one-to-one training, or self-guided tutorials? Why? Are there circumstances in which you feel a one-to-one...

-

what ways do you feel a sense of identity and belonging within the organization's community, and how does that influence your performance and engagement?

-

How do different generational cohorts within the workforce perceive and contribute to organizational culture, and what steps can organizations take to create a cohesive culture that bridges...

-

How do various tools and techniques such as adding slack (padding estimates) or project buffers help project managers perform duration estimates? What are some ethical considerations when using slack...

-

Dave the Lying King Inc., a mattress manufacturer, decides to participate in a pension plan commencing on January 1, 2013. The plan requires a pension payment each year following retirement. An...

-

The overall reaction and equilibrium constant value for a hydrogenoxygen fuel cell at 298 K is 2H 2 (g) + O 2 (g) 2H 2 O(l) K = 1.28 10 83 a. Calculate E cell and G 8 at 298 K for the fuel cell...

-

Benjamin has made no previous taxable gifts. Determine his gift tax if he makes $14,000,000 (after annual exclusions) in taxable gifts in 2019.

-

Joan is 15 and a dependent of her parents. If she has $5,000 income from her trust fund this year, how much income tax will she pay for 2019 if her parents $150,000 of taxable income?

-

Determine the credit for the gift and estate tax exclusion if the indexed exclusion in 2020 is $11,700,000.

-

Lou Barlow, a divisional manager for Sage Company, has an opportunity to manufacture and sell one of two new products for a five - year period. His annual pay raises are determined by his division s...

-

Consider a 5 year debt with a 15% coupon rate paid semi-annually, redeemable at Php1,000 par. The bond is selling at 90%. The flotation cost is Php50 per bind. The firm's tax bracket is 30%.

-

A project will generate annual cash flows of $237,600 for each of the next three years, and a cash flow of $274,800 during the fourth year. The initial cost of the project is $749,600. What is the...

Study smarter with the SolutionInn App