John dies on 3 March 2022. Between 6 April 2021 and 3 March 2022, he has capital

Question:

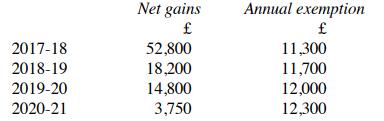

John dies on 3 March 2022. Between 6 April 2021 and 3 March 2022, he has capital gains of £1,200 and capital losses of £15,400. His net gains in recent tax years (and the annual exemption for each year) have been as follows:

Explain how (and to what extent) John's net losses in 2021-22 will be relieved.

Transcribed Image Text:

2017-18 2018-19 2019-20 2020-21 Net gains 52,800 18,200 14,800 3,750 Annual exemption 11,300 11,700 12,000 12,300

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 60% (5 reviews)

The question is related to the treatment of capital gains and losses for tax purposes in the UK As per the UK tax rules individuals are entitled to an ...View the full answer

Answered By

Nazrin Ziad

I am a post graduate in Zoology with specialization in Entomology.I also have a Bachelor degree in Education.I posess more than 10 years of teaching as well as tutoring experience.I have done a project on histopathological analysis on alcohol treated liver of Albino Mice.

I can deal with every field under Biology from basic to advanced level.I can also guide you for your project works related to biological subjects other than tutoring.You can also seek my help for cracking competitive exams with biology as one of the subjects.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Explain the meaning of the terms emoluments, employments and office for the purposes of PAYE as you earn systems. 2. Explain the actual receipts basis of assessing the emoluments from the employment...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-5. Ivan's grandfather died and left a portfolio of municipal bonds. In 2012, they pay Ivan...

-

A bakery with a December 31 st year end purchased new equipment on October 31 st 2000 for $10,000. This was their first equipment purchase. Required: What are the tax consequences if the equipment is...

-

Social welfare is maximized when O Total social benefits have been maximized O total social costs have been minimized O total social costs equal total social benefits O marginal social costs equal...

-

Exercise 6-22 gave data on the heights of female engineering students at ASU. (a) Can you support a claim that mean height of female engineering students at ASU is 65 inches? Use a = 0.05 (b) What is...

-

Based on this analysis, list some steps you would take to help your new copying business succeed.

-

What role do lessons learned and best practices play in continuous quality improvement? AppendixLO1

-

Presented below are the 2013 income statement and comparative balance sheets for Santana Industries. Additional information for the 2013 fiscal year ($ in thousands): 1. Cash dividends of $1,000 were...

-

On January 1, 2017, X Corp. is incorporated and is authorized to issue 1.5 million shares, $1 par, common stock. X Corp. is a Subchapter C corp. On January 2, 2017, X Corp. issues 500,000 shares of...

-

On what date is CGT for 2021-22 normally due for payment?

-

An individual has capital losses brought forward from previous years amounting to 4,800. Compute the individual's taxable gains for 2021-22 if total gains and losses for the year are as follows:...

-

Annular flow with inner cylinder moving axially (see Fig. 2B.7), a cylindrical rod of diameter KR moves axially with velocity v0 along the axis of a cylindrical cavity of radius R as seen in the...

-

MAT 152 Project 3: MLB Team Salaries The data set below is the total salary of each Major League Baseball (MLB) team salaries per team in 2016. Find the probabilities for normal distributions and...

-

deficit, surplusincreased, decreased$795, $1,975, $54,635, $35 6. Cash-flow statement Sam and Joan Wallingford have been married for two years. They have been trying to save but feel that there is...

-

Trudy bought the vacant lot adjacent to her house and planted a large garden there. The garden produces more vegetables than her family needs, and Trudy earns some extra cash by selling them at a...

-

Requirements Medical researchers once conducted experiments to determine whether Lisinopril is a drug that is effective in lowering systolic blood pressure of patients. Patients in a treatment group...

-

1. Balroop while looking for Gurjap walks 315m [N] toward the forest, then 133 m [28 S of E] through it, and finally finds him deep inside the forest after walking another 55 m [ 31 S of W]....

-

The file Hotel Away contains the average room price (in US$) paid in 2011 by people of various nationalities while traveling away from their home country: 171 166 159 157 150 148 147 146 Source: Data...

-

Estimate a range for the optimal objective value for the following LPs: (a) Minimize z = 5x1 + 2x2 Subject to X1 - x2 3 2x1 + 3x2 5 X1, x2 0 (b) Maximize z = x1 + 5x2 + 3x3 Subject to X1 + 2x2 +...

-

The following information relates to three companies that use the revaluation model in relation to intangible assets and prepare annual financial statements to 31 December: (a) Company W acquired an...

-

There are two international standards which deal with goodwill . IAS38 does not allow internally generated goodwill to be recognised as an asset. Goodwill acquired in a business combination is dealt...

-

An asset which cost £200,000 on 1 January 2016 is being depreciated on the straight line basis over a five year period with an estimated residual value of £40,000. The company which owns...

-

Show that the convexity for a zero coupon bond with m payments per year is (m) n(n + -)(1+ m m

-

Abdul Canarte , a Central Bank economist, noticed that the total group purchasing basket of goods (CPI) has gone from $149,740.00 to $344,460.00 in 8 years. With monthly compounding, what is the...

-

ABC Corporation expects sales next year to be $50,000,000. Inventory and accounts receivable (combined) will increase $8,000,000 to accommodate this sales level. The company has a profit margin of 6...

Study smarter with the SolutionInn App