Kelly Martin is divorced; her child, Barbara, lives with her and is her dependent. Kelly has the

Question:

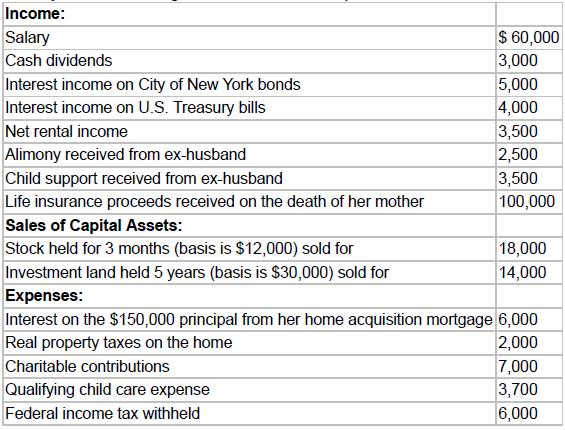

Kelly Martin is divorced; her child, Barbara, lives with her and is her dependent. Kelly has the following items of income and expense:

Compute Kelly’s taxable income and her net tax due or refund expected for 2017.

Transcribed Image Text:

Income: Salary Cash dividends Interest income on City of New York bonds Interest income on U.S. Treasury bills Net rental income $ 60,000 3,000 5,000 4,000 3,500 Alimony received from ex-husband 2,500 Child support received from ex-husband 3,500 Life insurance proceeds received on the death of her mother 100,000 Sales of Capital Assets: Stock held for 3 months (basis is $12,000) sold for 18,000 Investment land held 5 years (basis is $30,000) sold for 14,000 Expenses: Interest on the $150,000 principal from her home acquisition mortgage 6,000 Real property taxes on the home 2,000 Charitable contributions 7,000 Qualifying child care expense 3,700 Federal income tax withheld 6,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (1 review)

Answered By

Ankit Mahajan

I am an electrical engineering graduate from Thapar institute of engineering and technology.

Qualified exams - GATE 2019,2020.

CAT EXAM 2021- 91.4 percentile

SSC EXAMS- 2019,2020,2021

AFCAT EXAM- 2019,2020,2021

I want to share my knowledge with other people so that they can achieve the same.

I have strong hold Mathematics, Electrical engineering and all the subjects related.

Just give me a problem and I will give you the solution of it.

5.00+

1+ Reviews

10+ Question Solved

Related Book For

Taxation For Decision Makers 2018

ISBN: 9781119373735

8th Edition

Authors: Shirley Dennis Escoffier, Karen Fortin

Question Posted:

Students also viewed these Business questions

-

Kelly is single; her dependent child, Barbara, lives with her. After her divorce, Kelly was awarded permanent custody of Barbara and has not agreed to waive her right to claim Barbara as a dependent....

-

Kelly Martin is divorced; her dependent child, Barbara, lives with her and is her dependent. Kelly has the following items of income and expense: Income:...

-

Comprehensive Problem: Kelly Martin is divorced; her child, Barbara, lives with her and is her dependent. Kelly has the following items of income and expense: Income:...

-

Suppose the European Parliament is considering legislation that will decrease tariffs on agricultural products imported from the United States. The benefit of the tariff reduction is estimated at 5...

-

What will the real value of $100 be in 10 years if you hide the money under your mattress and the inflation rate is: (a) 0% (b) 2% (c) 8%

-

Which user group is likely to be most interested in the growth in wealth of the organisation, and the profit relative to the money tied up in the organisation? (a) lenders (b) investors (c) employees...

-

How would you respond to the argument that it is impossible to judge how successful a project like this one would have been unless you actually do it? When dignitaries broke ground on the Access to...

-

A government researcher is analyzing the relationship between retail sales and the gross national product (GNP). He also wonders whether there are significant differences in retail sales related to...

-

inear programming. The course grade is composed or the following components: midterm exam score, final exam score, individual assignments score, and class participation score. Cory Just received...

-

Lauren is single, age 60, and has an annual salary of $68,000. She paid off her mortgage in December 2016 but expects that her annual real estate taxes will continue to be approximately $5,800....

-

Which of the following individuals must file a tax return in 2017? a. Carolyn is single and age 66. She receives $2,000 of interest income, $3,000 of dividend income, and $6,000 in Social Security...

-

In Exercise, we repeat data from exercise. For each exercise, determine the linear correlation coefficient by using a. Definition 4.8 b. Formula 4.3 Compare your answers in parts (a) and (b). Linear...

-

On Apple company with specific iPhone product Required to conduct a SWOT and PESTEL analysis, identifying the internal strengths and weaknesses and external opportunities and threats of the Apple...

-

In which social platforms are Walmart's brand/company active? In your opinion, are they doing a good job regarding customer engagement through social media channels? (Required: screenshots from the...

-

After you have watched both films, how would you describe each film? Also, consider what makes these early films different. List as many observations as you can that separate the Lumi re brothers...

-

How to develop the following points with the Poshmark application for second hand? 1. What are the main reasons for using this product? Or why not? 2. What are the hidden motivations? 3. Are there...

-

Suppose, in an experiment to determine the amount of sodium hypochlorite in bleach, you titrated a 22.84 mL sample of 0.0100 M K I O 3 with a solution of N a 2 S 2 O 3 of unknown concentration. The...

-

Fata Food Emporium decides to obtain a new refrigerator to store its meat and produce. The refrigerator has a 15- year useful life and can be sold for $ 15,000 at the end of its useful life. Fata has...

-

How is use of the word consistent helpful in fraud reports?

-

Julie had a gross estate of $7 million when she died in 2016. Her funeral expenses were $26,000; her administrative expenses were $30,000; her charitable deduction was $350,000; and her marital...

-

Your client, Ted, would like your assistance in selecting one of the following assets to give to his 16-year-old daughter. The corporate stock pays only $100 in dividend income each year but has...

-

When Godfrey died in 2016, his assets were valued as follows: Asset Date of Death Valuation Valuation Six Months Later...

-

During 2024, its first year of operations, Hollis Industries recorded sales of $11,900,000 and experienced returns of $760,000. Cost of goods sold totaled $7,140,000 (60% of sales). The company...

-

What is the value of a 15% coupon bond with 11% return? Is it a discount or a premium bond?

-

A manufacturer with a December 31 taxation year end sells new machinery for $50,000 on January 2, 2022. The cost of the machinery is $20,000. The terms of the sale require an initial payment of...

Study smarter with the SolutionInn App