Martin Galloway, the sole proprietor of a consulting business, has gross receipts of $45,000 in 2017. His

Question:

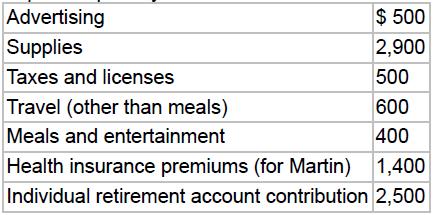

Martin Galloway, the sole proprietor of a consulting business, has gross receipts of $45,000 in 2017. His address is: 1223 Fairfield Street, Westfield, New Jersey and his SSN is 158-68-7799. Expenses paid by his business are

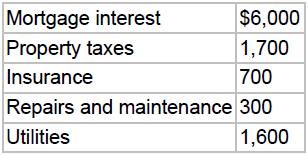

During the year, Martin drives his car a total of 15,000 miles (700 business miles and 550 personal miles per month). He paid $100 for businessrelated parking and tolls. He paid $120 in fines for speeding tickets when he was late for appointments with clients. Martin’s office is located in his home. His office occupies 500 of the 2,000 square feet in his home. His total (unallocated) expenses for his home are

Depreciation for the business portion of his home is $1,364.

a. What is Martin’s net income (loss) from his business?

b. How much self-employment tax must Martin pay?

c. Based on this information, are there any other deductions that Martin can claim on his individual tax return other than those reported on his Schedule C?

d. How would your answers to the above items change if Martin elects to use the simplified method for home office expenses?

Step by Step Answer:

Taxation For Decision Makers 2018

ISBN: 9781119373735

8th Edition

Authors: Shirley Dennis Escoffier, Karen Fortin