Norma has prepared a set of accounts for the nine-month period to 31 December 2021. The written

Question:

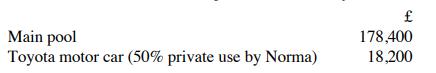

Norma has prepared a set of accounts for the nine-month period to 31 December 2021. The written down value of her plant and machinery at 31 March 2021 was as follows:

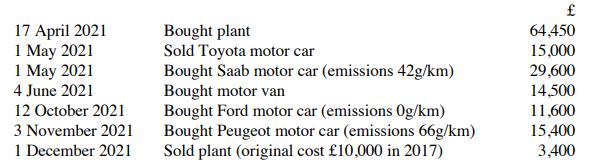

Plant and machinery transactions during the period to 31 December 2021 were:

There was 50% private use (by Norma) of the Toyota and Saab motor cars. Prepare a capital allowances computation for the period to 31 December 2021.

Transcribed Image Text:

Main pool Toyota motor car (50% private use by Norma) 178,400 18,200

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 50% (2 reviews)

Based on the information provided lets prepare the capital allowances computation for Normas business for the period ending on 31 December 2021 To do ...View the full answer

Answered By

Joseph Mwaura

I have been teaching college students in various subjects for 9 years now. Besides, I have been tutoring online with several tutoring companies from 2010 to date. The 9 years of experience as a tutor has enabled me to develop multiple tutoring skills and see thousands of students excel in their education and in life after school which gives me much pleasure. I have assisted students in essay writing and in doing academic research and this has helped me be well versed with the various writing styles such as APA, MLA, Chicago/ Turabian, Harvard. I am always ready to handle work at any hour and in any way as students specify. In my tutoring journey, excellence has always been my guiding standard.

4.00+

1+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Norma has prepared a set of accounts for the nine-month period to 31 December 2019. The written down value of her plant and machinery at 31 March 2019 was as follows: Main pool 178,400 Toyota motor...

-

ACE Ltd has prepared a set of accounts for the 11 months to 31 March 2021.These accounts show a profit before tax of 1,500,000. Relevant information is: (i) Depreciation charged in the period was...

-

Talat owns a large retail business and prepares accounts to 31 December each year. The written down value of his plant and machinery after deducting capital allowances for the year to 31 December...

-

2. National Defense (40 points). There are 11 countries in Europe who get utility from general consumption c, and from European national defense G. The utility of a generic country i is u(ci, G) =...

-

In Exercise 9-2, find the boundary of the critical region if the type I error probability is specified to be 0.05.

-

How do you think maintenance of the U.S. public health infrastructure might be achieved in an era of fiscal restraint?

-

The following errors were found in the books of Metro. Rectify them. (a) 1,000 paid for the purchase of machinery charged to the office expenses account. (b) 500 received from Vijay has been wrongly...

-

The Dapper-Dons Partnership was formed ten years ago as a general partnership to custom tailor men's clothing. Dapper-Dons is located at 123 Flamingo Drive in City, ST, 54321. Bob Dapper manages the...

-

Ed Co manufacture two exercise machines, the 'Power' and the 'Fit' using the same equipment. Ed Co currently uses a blanket overhead rate to assign overheads to products The finance director would...

-

Raymond started trading on 1 October 2020. He chose 31 March as his accounting date and his first accounts were for the period from 1 October 2020 to 31 March 2021. His purchases and sales of plant...

-

Laura started trading on 1 February 2021, preparing accounts to 31 January. Her adjusted trading profit for the year to 31 January 2022 (before deducting capital allowances) was 259,171. Her...

-

The wall of a liquid-to-gas heat exchanger has a surface area on the liquid side of 1.8 m2 (0.6m 3m) with a heat transfer coefficient of 255 W/(m2 K). On the other side of the heat exchanger wall...

-

At March 31, account balances after adjustments for Vizzini Cinema are as follows: Account Balances Accounts Cash Supplies Equipment (After Adjustment) $11,000 4,000 50,000 Accumulated...

-

2. "A student holds a thin aluminum pie pan horizontally 2 m above the ground and releases it. Using a motion detector, she obtains the graph shown in Figure P3.12. Based on her measurements, (a)...

-

Mark has two sticks, 25 inches, and 20 inches. If he places them end-to-end perpendicularly, what two acute angles would be formed when he added the hypotenuse?

-

A wedding website states that the average cost of a wedding is $29,205. One concerned bride hopes that the average is less than reported. To see if her hope is correct, she surveys 36 recently...

-

2. (10 pts each) Use partial fractions decomposition and the tables to find the inverse z- transform of each of the following: a. X(z)= 6z-z z3-4z2-z+4 4z2 b. G(z)=- (z-1) (z-0.5) 3z +1 c. X(z) =...

-

One of the major measures of the quality of service provided by an organization is the speed with which the organization responds to customer complaints. A large family-held department store selling...

-

Suppose a population of bacteria doubles every hour, but that 1.0 x 106 individuals are removed before reproduction to be converted into valuable biological by-products. Suppose the population begins...

-

Otlay Ltd prepares accounts to 31 July each year. The company's financial statements for the year to 31 July 2017 showed a liability for current tax of 120,000. This was an estimate of the current...

-

(a) Distinguish between current tax and deferred tax. (b) Distinguish between permanent differences and temporary differences. (c) Explain how temporary differences between accounting profits and...

-

Explain the concept of the "tax base" of an asset or liability. Explain how this concept helps to identify situations in which deferred tax adjustments are required.

-

Assignment Title: The Role of Bookkeeping in Business Management and Financial Reporting Objective: Understand the importance of proper bookkeeping procedures in the management of...

-

17) The adjustment that is made to allocate the cost of a building over its expected life is called:A) depreciation expense.B) residual value.C) accumulated depreciation.D) None of the above answers...

-

9) Prepaid Rent is considered to be a(n):A) liability.B) asset.C) contra-asset.D) expense.10) As Prepaid Rent is used, it becomes a(n):A) liability.B) expense. C) contra-asset.D) contra-revenue.11)...

Study smarter with the SolutionInn App