U Ltd has three subsidiaries (one of which is dormant) and has the following results for the

Question:

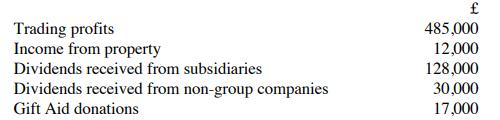

U Ltd has three subsidiaries (one of which is dormant) and has the following results for the year to 31 December 2021:

Compute the corporation tax liability for the year and state the date (or dates) on which this tax is due to be paid. Assume that the group has existed for many years.

Transcribed Image Text:

Trading profits Income from property Dividends received from subsidiaries Dividends received from non-group companies Gift Aid donations 485,000 12,000 128,000 30,000 17,000

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 33% (3 reviews)

To compute the corporation tax liability for U Ltd for the year ending 31 December 2021 we need to start with the taxable profits and apply any releva...View the full answer

Answered By

Mugdha Sisodiya

My self Mugdha Sisodiya from Chhattisgarh India. I have completed my Bachelors degree in 2015 and My Master in Commerce degree in 2016. I am having expertise in Management, Cost and Finance Accounts. Further I have completed my Chartered Accountant and working as a Professional.

Since 2012 I am providing home tutions.

3.30+

2+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

The trial balance for LPO at 31 December 2013 was as follows: Notes: (i) Closing inventory at 31 December 2013 was $562,000. (ii) On 31 December 2013, LPO disposed of some obsolete plant and...

-

The Crazy Eddie fraud may appear smaller and gentler than the massive billion-dollar frauds exposed in recent times, such as Bernie Madoffs Ponzi scheme, frauds in the subprime mortgage market, the...

-

Your broker has offered to sell you a bond with a maturity of 4 years, a face value of $100, and that pays annual coupons with a coupon rate of 4%,. The current price of the bond is $98. What is the...

-

Part A.: You are considering launching a strategic alliance with a competitor to join your separate skills to develop a new jointly owned technology. Both you and your partner have the option of...

-

A cooling tower with a cooling capacity of 100 tons (440 kW) is claimed to evaporate 15,800 kg of water per day. Is this a reasonable claim?

-

What advantages might the focus group method offer in contrast to an individual qualitative interview?

-

Explain the methods used to allocate the integrated marketing communications (IMC) budget.

-

The data in Table 9E.1 represent individual observations on molecular weight taken hourly from a chemical process. The target value of molecular weight is 1,050 and the process standard deviation is...

-

Problem 18. incorred Cardinal Industries purchased generator that cost $11,000. It has an estimated We offive years and residual value of $1.000 is estimated with good 5.000 home the pense for the...

-

A structural tee section is used as a cantilever beam to support a triangular distributed load of maximum intensity w = 600 NM and a concentrated load P =1 kN. as shown in Fig. P6.3-22. Determine the...

-

Basenote Ltd is a wholly-owned subsidiary of Apexine Ltd. Both companies are UK resident and prepare accounts to 31 March each year. Results for the year to 31 March 2022 are as follows: Calculate...

-

Armco1 Ltd and Armco2 Ltd are 100% subsidiaries of Headco Ltd, which has no other subsidiaries. They are all UK resident and the group has existed for several years. How will the relationship of the...

-

Paradise, Inc., has identified an investment project with the following cash flows. If the discount rate is 8 percent, what is the future value of these cash flows in year 4? What is the future value...

-

460 V rms 3 phase full wave controlled rectifier feeds an inductive load. The supply voltage has a frequency of 50 Hz. If thyristors are considered ideal; a) Draw the voltage on the load when a = 25....

-

The following data is provided for Garcon Company and Pepper Company for the year ended December 31. Garcon Company Pepper Company Finished goods inventory, beginning $14,000 $17,950 Work in process...

-

On September 22, 2024, a flood destroyed the entire merchandise inventory on hand in a warehouse owned by the Rocklin Sporting Goods Company. The following information is available from the records...

-

A wound DC motor is connected in both a shunt and a series configuration. Assume generic resistance and inductance parameters Ra, Rf, La, Lf, let the field magnetization constant be kf and the...

-

Supermart Food Stores (SFS) has experienced net operating losses in its frozen food products line in the last few periods. Management believes that the store can improve its profitability if SFS...

-

Air enters a turbojet engine at 320 m/s at a rate of 30 kg/s, and exits at 650 m/s relative to the aircraft. The thrust developed by the engine is (a) 5 kN (b) 10 kN (c) 15 kN (d) 20 kN (e) 26 kN

-

Calculate I, , and a for a 0.0175 m solution of Na 3 PO 4 at 298 K. Assume complete dissociation. How confident are you that your calculated results will agree with experimental results?

-

The following trial balance has been extracted from the accounting records of Walrus plc as at 31 March 2023: The following information is also available: 1. Non-depreciable land was valued at...

-

Roger began trading on 1 January 2011 , preparing accounts to 30 April each year. His first accounts were for the 16 months to 30 April 2012. In 2014 he decided to change his accounting date to 30...

-

Belinda began trading on 1 March 2013 and chose 31 December as her accounting date. Her first accounts were fo r the period to 31 Decemb er 2013. She eventually decided to change her accounting date...

-

Imagine you are an Investor in the Stock Market. Identify three companies in the Korean Stock Market (KOSPI) where you would like to invest. Explain your answer

-

Domino is 4 0 years old and is married out of community of property with the exclusion of the accrual system to Dolly ( 3 5 ) . They have one child, Domonique, who is 1 1 years old. Domino resigned...

-

YOU ARE CREATING AN INVESTMENT POLICY STATEMENT FOR JANE DOE General: 60 years old, 3 grown children that are living on their own and supporting themselves. She is in a very low tax rate so we don't...

Study smarter with the SolutionInn App