Yvonne made the following acquisitions of ordinary shares in Ranghi plc: In January 2021, the company made

Question:

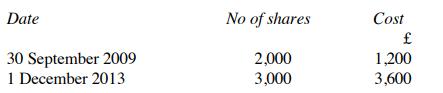

Yvonne made the following acquisitions of ordinary shares in Ranghi plc:

In January 2021, the company made a 1 for 5 rights issue at £1 per share and Yvonne decided to buy the shares which she was offered. In March 2022, she sold one-half of her shares in the company for £1.80 per share. Calculate the chargeable gain arising in March 2022, given that no further shares were acquired within the following 30 days.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: