What is your after-tax rate of return on taxable bonds? $100 will grow to $110 at a

Question:

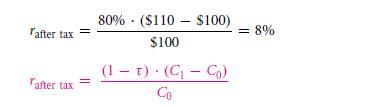

What is your after-tax rate of return on taxable bonds? $100 will grow to $110 at a 10% interest rate before tax, minus the 20% that Uncle Sam collects. Uncle Sam takes 1.1 . $100 = $110, subtracts $100, and then leaves you with only 80% thereof:

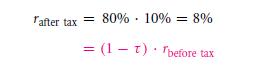

where τ is your tax rate of 20%. (C1 − C0)/C0 is the before-tax rate of return, so this is just

Now, in before-tax terms, your project offers a 15% rate of return. In after-tax terms, the project offers 80% . $3,000 = $2,400 net return. On your investment of $20,000, this is a 12% after-tax rate of return.

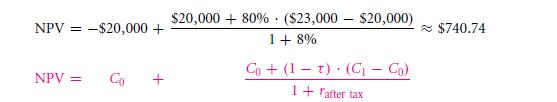

(On the same $20,000, the taxable bond would offer only 80% . ($22,000 − $20,000) = $1,600 net return (8%). So, you know that the NPV should be positive.) Therefore, the project NPV is

You can now easily substitute any other cash flows or interest rates into these formulas to obtain the NPV.

Note that everything is computed in nominal dollars, so you do not need the information about the inflation rate! (And you needed it in nominal, because taxes are computed based on nominal gains, not real gains.)

Step by Step Answer: