Antismoking advocates cheered in the summer of 1997 when the U.S. tobacco industry agreed to pay out

Question:

Antismoking advocates cheered in the summer of 1997 when the U.S. tobacco industry agreed to pay out more than U.S.

\($368.5\) billion to settle lawsuits brought by forty states seeking compensation for cigarette-related Medicaid costs. Mississippi Attorney General Mike Moore, who helped organize the states’ legal campaign, called the pact “the most historic public health achievement in history.” But were the states right to do what they did?

The fundamental premise of lawsuits and other antitobacco initiatives is that smokers—and, hence, tobacco companies

—place an added tax on all of us by heaping extra costs onto public health care systems.

The argument is that those and other social costs outweigh the billions in duty and tax revenue that our governments collect from cigarette distribution.

But a basic actuarial analysis of that premise suggests that quite the opposite is true. As ghoulish as it may sound, smokers save the rest of us money because they die sooner and consume far less in health care and in benefits such as pensions. The extra costs they do generate are far outweighed by the subsidies they pay each time they plunk down their money for a pack of cigarettes.

First of all, let’s look at life expectancy consistently over the past decade. In 1994, testimony before the U.S. Senate Finance Committee of the U.S. Office of Technology Assessment showed that the average smoker dies fifteen years earlier than a nonsmoker, so smokers cost society less in health care bills than nonsmokers because they die about a decade earlier. The longer a person lives, the more it costs to treat him or her, especially since the vast majority of health care costs occur in the last few years of life.

One of the paradoxes of modern medicine is that advances in treatments that extend lives have actually increased lifetime health care costs. People who would have died from an acute illness during their working life in the past are now enjoying lengthy retirements and suffering various debilitating diseases that require high-cost medical intervention. According to an expert, former Colorado governor Richard Lamm, director of the Center for Public Policy and Contemporary Issues at the University of Denver, the average nonsmoker is treated for seven major illnesses during his or her lifetime. The average smoker survives only two major illnesses.

So how much more do nonsmokers add to the national health care bill than smokers?

One of the best studies is by Duke University economist Kip Viscusi,2 who conducted an exhaustive comparative analysis in 1994 for a conference on tax policy hosted by the National Bureau of Economic Research in Washington, D.C.

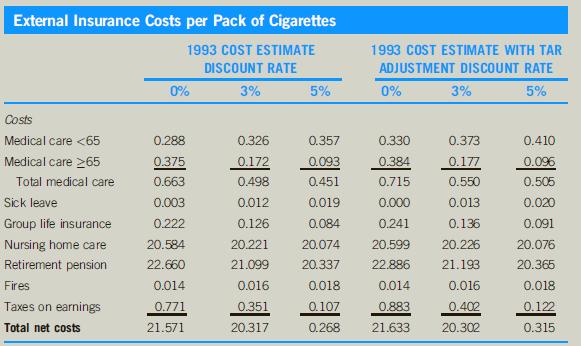

Viscusi concluded that smokers, in essence, subsidize the health care costs of nonsmokers. Using government statistics, Viscusi calculated the medical costs of tobacco by adding up things like the percentage of patient days for lung cancer treatment in hospitals that can be attributed to smoking and burn injuries and deaths from fires started by mislaid cigarettes.

Viscusi then took into account other costs—by dying younger, smokers deprive society of income tax. Viscusi even added a charge for costs related to secondhand smoke. Viscusi then calculated how much tobacco saves society. Because they receive considerably fewer payments from government and employer pension plans and other retirement benefits and consume fewer drug benefits, nursing home, and hospital dollars, he estimates that the average American smoker saves society on each pack of cigarettes sold in the United States, leaving a net surplus of 31 cents over the costs attributable to smoking (see 3%

discount column below). Adding the 80 cents per package in taxes that American smokers pay brings the total surplus to

\($1.11\) for every pack of smokes.

Other experts have argued that there is a loss of productivity to society because smokers take more sick days than nonsmokers.

But is this cost borne by the economy as a whole or by individual smokers whose absences mean that they will not reach their full earnings potential due to missed job promotions and merit pay? The bottom line in all this is that an actuarial approach shows that the facts do not support current political claims about the cost of smoking.

Smokers actually leave the economy better off and should be encouraged, not discouraged through taxes, restrictions, and lawsuits.

Questions:-

1. What can an ethical analysis add to Viscusi’s actuarial analysis?

2. Would an ethical analysis change the conclusion reached? Why?

Step by Step Answer:

Business And Professional Ethics

ISBN: 9781337514460

8th Edition

Authors: Leonard J Brooks, Paul Dunn