On May 18, 2002, Tyco CEO Dennis Kozlowski, who had received his degree in accounting and finance

Question:

On May 18, 2002, Tyco CEO Dennis Kozlowski, who had received his degree in accounting and finance from Seton Hall University in 1968, gave the commencement address to St. Anselm’s College in Manchester, New Hampshire. He talked about the difficult decisions that the graduates would face during their lifetimes.

He stated that the graduates would have questions that would test their moral standards. He told the students that the questions would get tougher and the potential consequences would be more severe, so his advice was to not do the easy thing, but to do the right thing.1 Less than 2 weeks later, on June 1, 2002, Dennis Kozlowski, who had worked at Tyco since 1975, announced to the board of directors for Tyco International that he was the subject of a criminal investigation in New York for evasion of sales taxes on a painting he had purchased in Manhattan. The board of directors demanded that he step down as CEO, which he did on June 3, 2002. Tyco told the media that Kozlowski had resigned for “personal reasons.” By resigning rather than being fired, Kozlowski was no longer eligible for a severance package that was valued at approximately $120 million. Previous Tyco CEO John Fort took over as interim CEO. Fort, Tyco’s CEO from 1982 to 1992, had stopped using the company jet and sold off the president’s house and other corporate-held apartments during his first reign. In an ironic example of déjà vu, Fort, who was on the board of directors of Tyco, had to address the same issues of management’s misuse of corporate funds in 2002 that he dealt with in 1982.

The Financial Troubles Begin

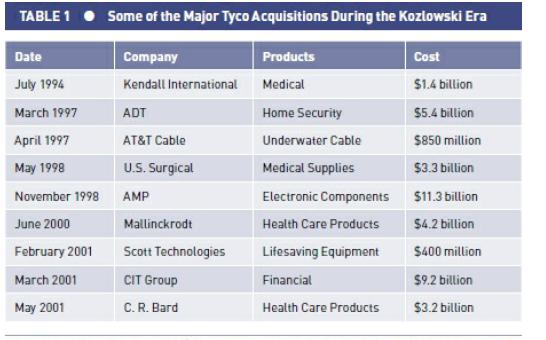

It was not a pleasant time for Tyco because the company had lost $86 billion in market capitalization due to concerns investors had about the company’s strategic focus. In addition, a number of critics were complaining about the compensation levels given to Kozlowski and other members of Tyco’s management. During his tenure, Tyco’s stock had fallen from $60 in December 2001 to $16.05 in June 2002. In addition, Tyco had accumulated $27 billion in debt through various acquisitions. Kozlowski was called “Deal a Month Dennis” for his aggressive acquisition style. He said his goal was to create the new General Electric. Some of the major acquisitions are shown in Table 1. In his 10 years as CEO, through growth via acquisitions, Kozlowski grew the size of Tyco from $2 billion when he took over the CEO position in 1989 to a conglomerate with annual sales of $36 billion at the end of fiscal year 2001. Tyco had a quarter of a million employees worldwide and had a market capitalization of $120 billion. By the time of his resignation, Kozlowski had exercised $240 million in stock options and had been paid almost $100 million over the previous 3 years. In addition, Kozlowski owned residences in New York, New Hampshire, and Florida and on Nantucket Island. His New York apartment was reportedly bought for $18.5 million in 2000. His distaste for paying taxes led him to move the corporate headquarters to Bermuda from Exeter, New Hampshire, in 1997 to reduce Tyco’s tax liability to 20%, which is approximately half the average corporate rate for U.S.-based firms.

Paying for Empty Crates

Kozlowski’s distaste for paying taxes extended to his personal life as well. When he purchased approximately $8 million to $12 million worth of paintings in New York, he had the art gallery ship them to New Hampshire to avoid paying the 8.25% New York State and Manhattan combined sales tax, even though they were to be hung in his Fifth Avenue apartment.4 On June 4, 2002, Kozlowski was indicted by a grand jury for tax evasion for avoiding to pay between $650,000 to $1 million in taxes on the six paintings that he had purchased in the fall of 2001. In addition, he was also charged with tampering with evidence and willfully falsifying financial records. He was ordered to surrender his passport and was released on a $3 million bond.

One piece of evidence that prosecutors were able to obtain was a fax that listed the paintings Kozlowski had purchased, which were supposed to be shipped to New Hampshire, with the words wink, wink in parentheses. From August to December 2001, Kozlowski had bought approximately 12 paintings, including a Renoir and a Monet. In total, the artwork was valued at more than $15 million. Karen Kozlowski, Dennis’s wife, worked with art gallery director Christine Berry to help purchase the art for the Kozlowskis’ Fifth Avenue apartment. Some of the paintings were sent to the apartment to see how they looked on the walls before they were purchased. In December 2001, the Kozlowskis purchased a Monet for almost $4 million from a private Manhattan dealer. The art dealer, Alexander Apsis, did not charge sales tax on the painting because Kozlowski gave him a written document that stated that the painting was going to be shipped to New Hampshire. However, the painting went to the Manhattan apartment, which is less than two blocks from the art dealer’s office. On January 2, 2002, five empty boxes were shipped to New Hampshire and signed for by a Tyco employee......

Questions

1. What do you think Kozlowski’s motivation was for trying to evade sales taxes on his art purchases? Explain.

2. Explain the concept of commingling assets with respect to the Tyco case.

3. Would it have been possible for the board of directors to see the adjustments taking place in the many different programs at Tyco? Explain.

4. Is it realistic, in your mind, that the auditors could have missed such blatantly fraudulent transactions?

Explain.

Step by Step Answer:

Understanding Business Ethics

ISBN: 9781506303239

3rd Edition

Authors: Peter A. Stanwick, Sarah D. Stanwick