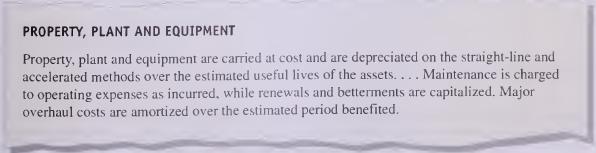

A recent annual report for AMERCO. the holding company for U-Haul International, Inc., included the following note:

Question:

A recent annual report for AMERCO. the holding company for U-Haul International, Inc., included the following note:

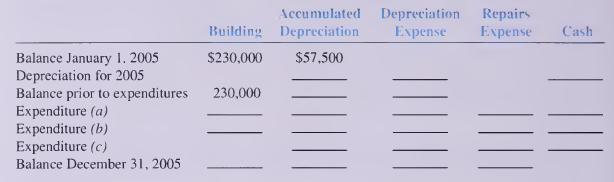

AMERCO subsidiaries own property, plant, and equipment that are utilized in the manufacture, repair, and rental of U-Haul equipment and that provide offices for U-Haul. Assume that AMERCO made extensive repairs on an existing building and added a new wing. The building is a garage and repair facility for rental trucks that serve the Seattle area. The existing building originally cost S230.0O0. and by the end of 2004 (its fifth year), the building was one-quarter depreciated on the basis of a 20-year estimated useful life and no residual value. Assume straight-line depreciation computed to the nearest month. During 2005, the following expenditures related to the building were made:

a. Ordinary repairs and maintenance expenditures for the year, $5,000 cash.

b. Extensive and major repairs to the roof of the building, $17,000 cash. These repairs were completed on December 31, 2005.

c. The new wing was completed on December 31, 2005, at a cash cost of $70,000.

Required: 1. Applying the policies of AMERCO, complete the following, indicating the effects for the preceding expenditures. If there is no effect on an account, write NE on the line: 2. What was the book value of the building on December 31, 2005? 3. Explain the effect of depreciation on cash flows.

2. What was the book value of the building on December 31, 2005? 3. Explain the effect of depreciation on cash flows.

Step by Step Answer: