A recent annual report for Federal Express included the following note: Assume that Federal Express made extensive

Question:

A recent annual report for Federal Express included the following note:

Assume that Federal Express made extensive repairs on an existing building and added a new wing.

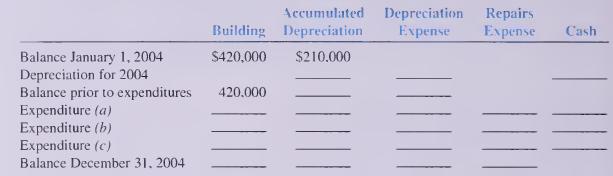

The building is a garage and repair facility for delivery trucks that serve the Denver area. The existing building originally cost $420,000, and by the end of 2003 (10 years), it was half depreciated on the basis of a 20-year estimated useful life and no residual value. Assume straight-line depreciation computed to the nearest month. During 2004, the following expenditures related to the building were made:

a. Ordinary repairs and maintenance expenditures for the year, $7,000 cash.

b. Extensive and major repairs to the roof of the building. $22,000 cash. These repairs were completed on December 31. 2004.

c. The new wing was completed on December 3 1 . 2004. at a cash cost of $ 1 30.000.

Required: 1. Applying the policies of Federal Express, complete the following, indicating the effects for the preceding expenditures. If there is no effect on an account, write NE on the line: 2. What was the book value of the building on December 3 1 , 2004? 3. Explain the effect of depreciation on cash flows.

2. What was the book value of the building on December 3 1 , 2004? 3. Explain the effect of depreciation on cash flows.

Step by Step Answer: