After completing a long and successful career as senior vice president for a large bank, you are

Question:

After completing a long and successful career as senior vice president for a large bank, you are preparing for retirement. After visiting the human resources office, you have found that you have several retirement options: (1) you can receive an immediate cash payment of $1 million, (2) you can receive

$60,000 per year for life (you have a life expectancy of 20 years), or (3) you can receive $50,000 per year for 10 years and then $70,000 per year for life (this option is intended to give you some protection against inflation). You have determined that you can earn 8 percent on your investments. Which option do you prefer and why?

Computing Amounts for a Fund with Journal Entries (P9-11)

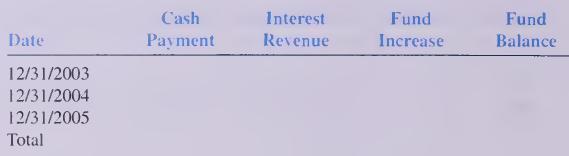

On January 1, 2003, Jalopy Company decided to accumulate a fund to build an addition to its plant.

The company will deposit $320,000 in the fund at each year-end, starting on December 3 1 , 2003. The fund will earn 9 percent interest, which will be added to balance at each year-end. The accounting period ends December 3 1

.

Required: 1. What will be the balance in the fund immediately after the December 31, 2005, deposit? 2. Complete the following fund accumulation schedule: 3. Give journal entries on December 31. 2003. 2004. and 2005. 4. The plant addition was completed on January 1 . 2006 for a total cost of S 1 .060.000. Give the entry, assuming that this amount is paid in full to the contractor.

3. Give journal entries on December 31. 2003. 2004. and 2005. 4. The plant addition was completed on January 1 . 2006 for a total cost of S 1 .060.000. Give the entry, assuming that this amount is paid in full to the contractor.

Step by Step Answer: