(After-tax cash flows; payback; NPV; PI; IRR) Ludwig Fashions is considering the purchase of computerized clothes designing...

Question:

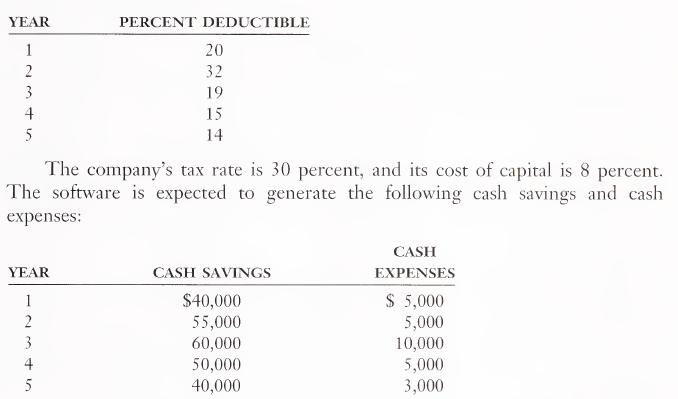

(After-tax cash flows; payback; NPV; PI; IRR) Ludwig Fashions is considering the purchase of computerized clothes designing software. The software is expected to cost $125,000, have a useful life of 5 years, and have a zero salvage value at the end of its useful life. Assume tax regulations permit the following depreci¬ ation patterns for this asset

a. Prepare a timeline presenting the after-tax operating cash flows.

b. Determine the following on an after-tax basis: payback period, net present value, profitability index, and internal rate of return.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: