(Alternative depreciation methods; NPV) New England Papermill Company is con sidering an investment in a revolutionary new...

Question:

(Alternative depreciation methods; NPV) New England Papermill Company is con¬ sidering an investment in a revolutionary new paper-making mill. The mill will cost $20,000,000, have a life of 8 years, and generate annual net before-tax cash flows from operations of $4,200,000. The paper mill will have no value at the end of its 8-year estimated life. New England Papermill’s tax rate is 30 percent, and its cost of capital is 8 percent.

a. If New England Papermill uses straight-line depreciation for tax purposes, is the project acceptable using the net present value method?

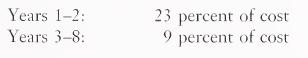

b. Assume the tax law allows the company to take accelerated annual depreci¬ ation on this asset in the following manner:

What is the net present value of the project? Is it acceptable?

c. Recompute parts a and

b, assuming the tax rate is increased to 50 percent.

Step by Step Answer: