Anna Malover is a full-time veterinarian who started her own business five years ago. Anna felt that

Question:

Anna Malover is a full-time veterinarian who started her own business five years ago. Anna felt that the market for doggie fashions had a lot of promise, based on her clients’ complaints about fashionable doggie clothes being so hard to find. She decided to start a business to design, make, and sell a line of high-fashion doggie clothes including hats, booties, sweaters, and coordinating accessories under the name Doggie Duds.

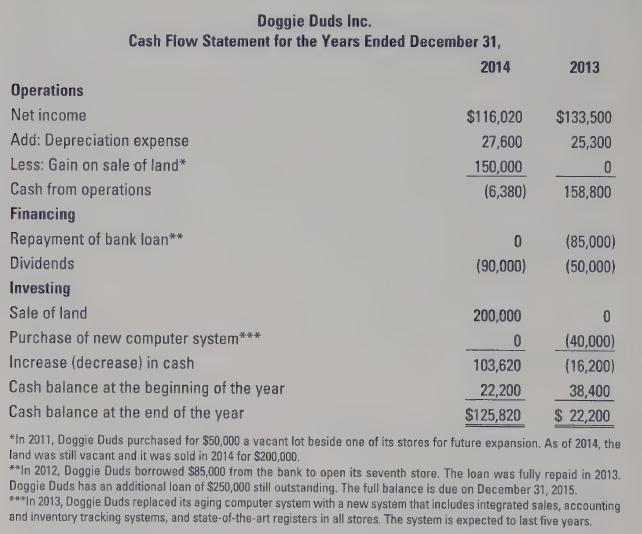

Anna wanted to continue her career as a full-time veterinarian and hired a fulltime manager to manage Doggie Duds on a day-to-day basis. Anna has never been involved in the daily operations of the company, relying on periodic meetings with the manager and the company’s annual financial statements. Since the business started, it has grown to be the number-one provider of dog clothes and accessories in the country, with seven stores across Ontario and Quebec. Anna has come to rely on the cash flow generated by Doggie Duds to support her lifestyle and usually pays herself a significant cash dividend each year.

After seeing the cash flow statement for 2013, Anna was very disappointed that the cash balance had decreased for the first time since the business began. As a result, she fired the manager for his poor performance and hired a new manager, Hue Gego, to

“turn around” the company in 2014. Anna offered Hue a bonus based on the increase in total cash from 2013 to 2014.

It’s now January 2015. Upon seeing the 2014 financial statements, Anna is very pleased with her decision, noting that cash increased significantly during the year. As a result, Anna was able to increase her dividend for the year to $90,000.

Required

a. Who are the users of the Doggie Duds financial statements? What will they be using the statements for? Discuss the possible objectives of financial reporting for Doggie Duds.

b. Do you think that Anna was justified in firing the manager based on poor performance in 2013? Why or why not?

c. Do you think that the company performed as well as Anna thinks in 2014? Why or why not?

d. Do you think it’s wise of Anna to offer a bonus based on the overall increase in cash? Why or Why not?

Note: This question was written by Angela Kellett of the University of Ontario Institute of Technology and is used with permission.

Step by Step Answer: