Barkway Inc. (Barkway) is in the process of finalizing its cash flow statement for 2014. The statement

Question:

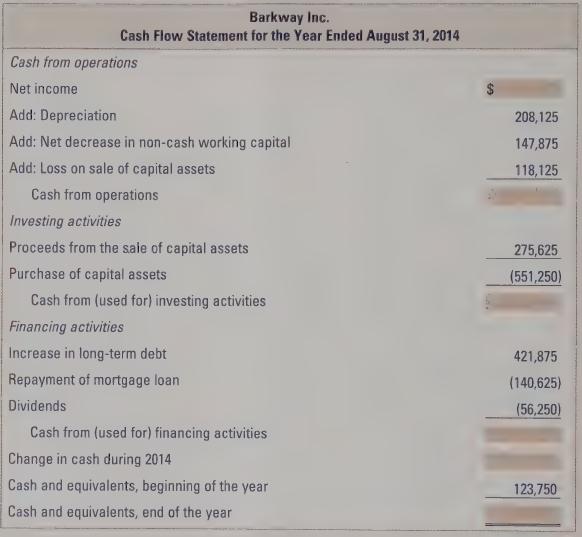

Barkway Inc. (Barkway) is in the process of finalizing its cash flow statement for 2014.

The statement has been completely prepared except for the new product development costs that the controller hasn’t decided how to account for. Preliminary net income, before accounting for the development costs, is $325,000. The product development costs for the year are $375,000. Based on the controller’s interpretation of the relevant accounting standards, an argument could be made for either capitalizing the costs or expensing them. Barkway’s preliminary cash flow statement is shown below (the product development costs aren’t reflected in the cash flow statement):

Required:

a. Complete the cash flow statement (shaded boxes) assuming that i. the new product development costs are capitalized and depreciated ii. the new product development costs are expensed as incurred Assume that if the product development costs are capitalized it isn’t necessary to depreciate any of the costs in 2014.

b. Compare the two cash flow statements. How is your evaluation of Barkway influenced by them?

c. How are the balance sheet and income statement affected by the different accounting treatments for the new product development costs?

d. If Barkway’s management received bonuses based on net income, which treatment for the product development costs do you think they would prefer? Explain.

Step by Step Answer: