Big Rock Brewery Inc. is a regional producer of craft beers and cider. The companys products are

Question:

Big Rock Brewery Inc. is a regional producer of craft beers and cider. The company’s products are sold in nine provinces and territories in Canada. Exhibits 10.17A to 10.17D contain extracts from Big Rock’s 2016 annual report.

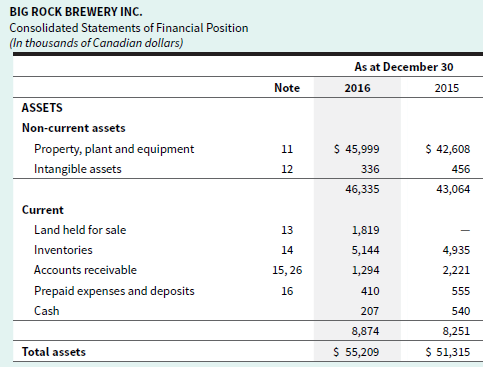

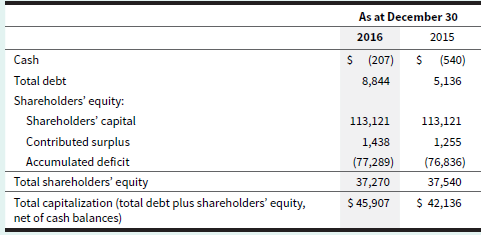

EXHIBIT 10.17A Big Rock Brewery Inc.’s 2016 Consolidated Statements of Financial Position

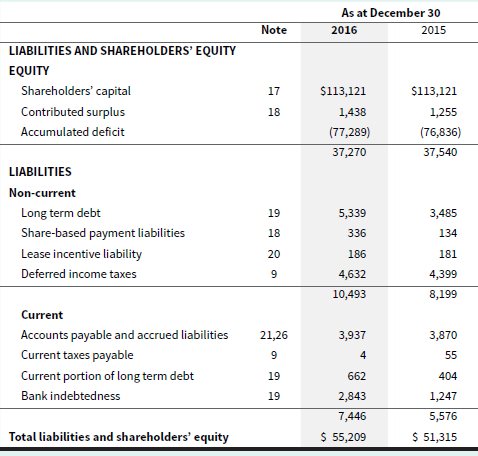

EXHIBIT 10.17B Big Rock Brewery Inc.’s 2016 Consolidated Statements of Comprehensive Loss

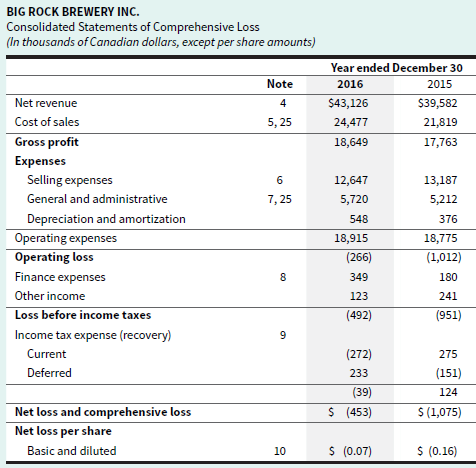

EXHIBIT 10.17C Big Rock Brewery Inc.’s 2016 Consolidated Statements of Cash Flows

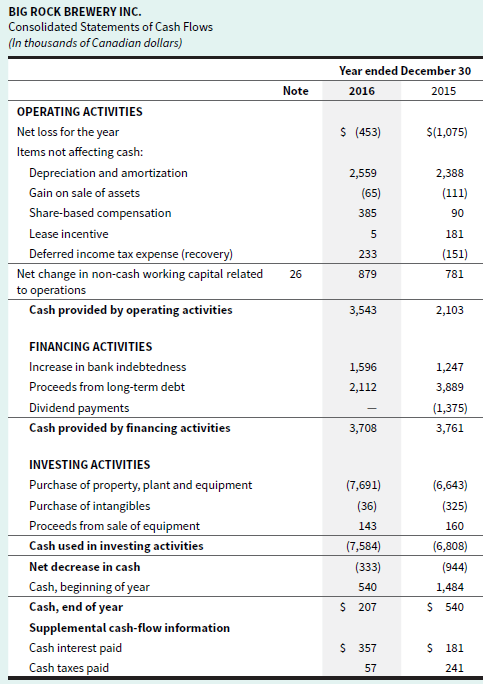

EXHIBIT 10.17D Excerpt from Big Rock Brewery Inc.’s 2016 Annual Report

23. CAPITAL RISK MANAGEMENT

The Corporation defines its capital to include: common shares plus short-term and long-term debt, less cash balances. There are no externally imposed capital requirements on Big Rock. The Corporation’s objectives are to safeguard the Corporation’s ability to continue as a going concern, to support the Corporation’s normal operating requirements and to maintain a flexible capital structure which optimizes the cost of capital at an acceptable risk. This allows management to maximize the profitability of its existing assets and create long-term value and enhance returns for its shareholders.

The Corporation manages the capital structure through prudent levels of borrowing, cash-flow forecasting, and working capital management. Adjustments are made by considering changes in economic conditions and the risk characteristics of the underlying assets. In order to maintain or adjust the capital structure, the Big Rock may issue new shares, issue or renegotiate its debt, acquire or dispose of assets or adjust the amount of cash and cash equivalents. Capital requirements of the Corporation are managed by the preparation of an annual expenditure budget which is approved by the Board of Directors and monitored on a regular basis by Management. The budget is updated as necessary depending on various factors, including capital deployment, results from operations, and general industry conditions. In addition, the Corporation monitors its capital using ratios of (i) earnings before interest, taxes, depreciation and amortization (“EBITDA”) to net debt (debt less cash) and (ii) EBITDA to interest, debt repayments and dividends. EBITDA to net debt is calculated by dividing debt minus cash by EBITDA. EBITDA to interest, debt repayments and dividends is calculated by dividing the combined interest, debt repayments and dividend amounts by EBITDA. These capital management policies, which remain unchanged from prior periods, provide Big Rock with access to capital at a reasonable cost.

Required

a. Calculate the ratios that the management of Big Rock Brewery have indicated they monitor in relation to their management of capital.

b. Write a short report commenting on the results of the ratio calculations in part “a.”

Capital StructureCapital structure refers to a company’s outstanding debt and equity. The capital structure is the particular combination of debt and equity used by a finance its overall operations and growth. Capital structure maximizes the market value of a... Corporation

A Corporation is a legal form of business that is separate from its owner. In other words, a corporation is a business or organization formed by a group of people, and its right and liabilities separate from those of the individuals involved. It may... Cost Of Capital

Cost of capital refers to the opportunity cost of making a specific investment . Cost of capital (COC) is the rate of return that a firm must earn on its project investments to maintain its market value and attract funds. COC is the required rate of... Dividend

A dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley