Question:

Big Rock Brewery Inc. is Calgary-based public company. The company is a producer of all-natural craft beers and cider. Its products are sold in nine provinces and three territories in Canada. The 2016 consolidated statements of comprehensive income (loss), financial position, and cash flows are shown in Exhibits 12.12A to 12.12C (amounts in thousands).

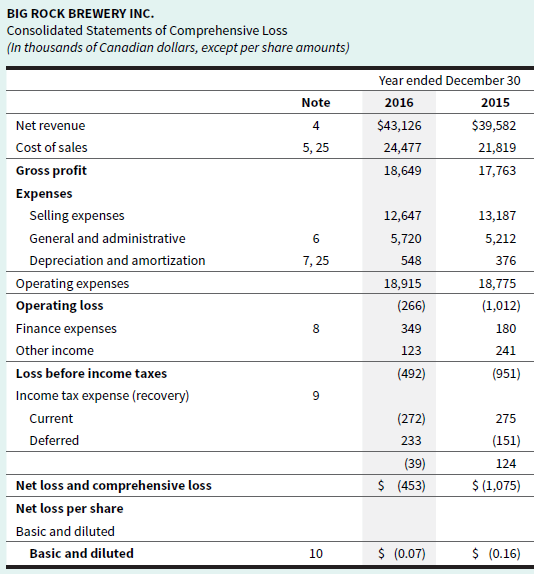

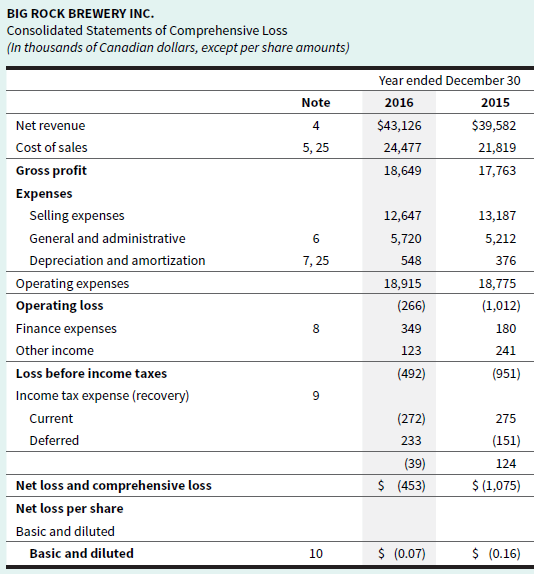

EXHIBIT 12.12A Big Rock Brewery Inc.’s 2016 Consolidated Statements of Comprehensive Income

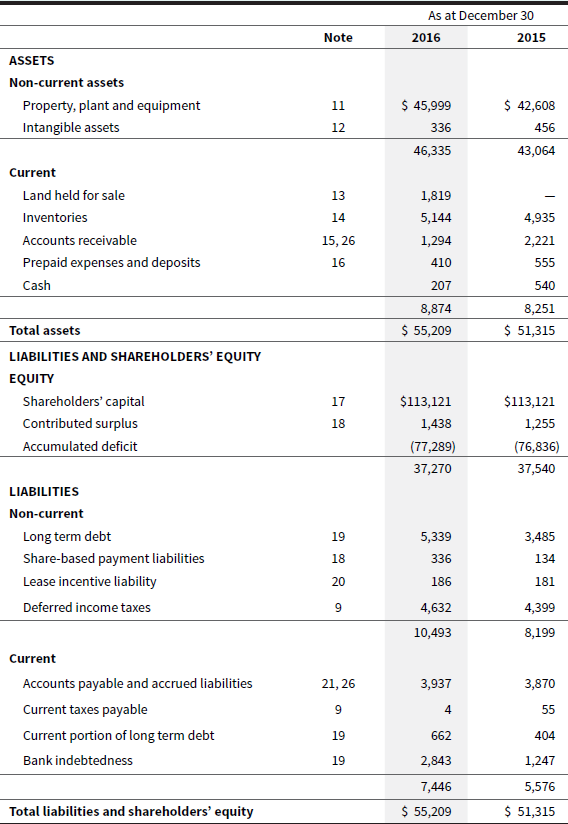

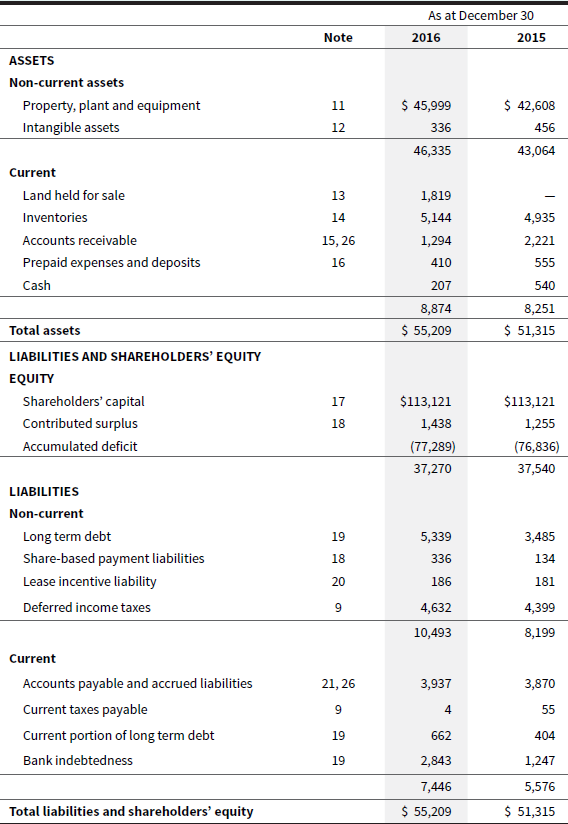

EXHIBIT 12.12B Big Rock Brewery Inc.’s 2016 Consolidated Statements of Financial Position

BIG ROCK BREWERY INC.

Consolidated Statements of Financial Position

(In thousands of Canadian dollars)

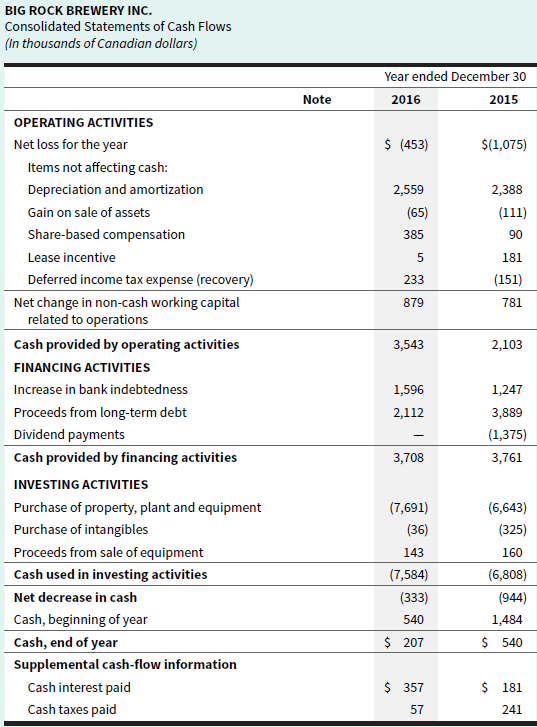

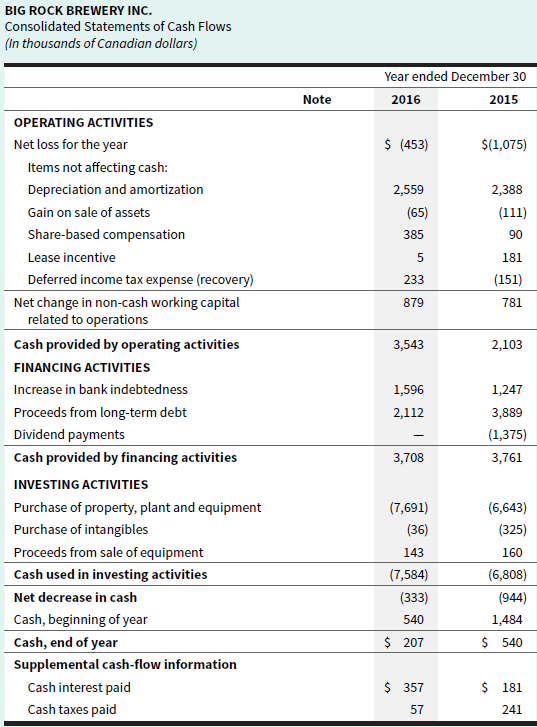

EXHIBIT 12.12C Big Rock Brewery Inc.’s 2016 Consolidated Statements of Cash Flows

Required

Use the financial statements in Exhibits 12.12A to 12.12C to do the following:

a. Calculate the following ratios for both 2016 and 2015:

i. Current ratio

ii. Quick ratio

iii. Inventory turnover

iv. Days to sell inventory

b. Comment on Big Rock’s liquidity.

c. Calculate the following ratios for both 2016 and 2015, and comment on the changes:

i. Return on assets

ii. Return on equity

d. Comment on the use of leverage by Big Rock, using appropriate ratios to support your analysis.

e. Calculate Big Rock’s net free cash fl ow for 2016 and 2015. What does this tell us about the company’s financial flexibility?

f. What do you know about Big Rock given that its basic and diluted earnings per share amounts are the same?

Financial Statements

Financial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial...

Transcribed Image Text:

BIG ROCK BREWERY INC. Consolidated Statements of Comprehensive Loss (In thousands of Canadian dollars, except per share amounts) Year ended December 30 2016 Note 2015 $43,126 $39,582 Net revenue 4 Cost of sales 5, 25 24,477 21,819 Gross profit 18,649 17,763 Expenses Selling expenses 13,187 12,647 General and administrative 5,720 5,212 7, 25 Depreciation and amortization 548 376 Operating expenses 18,915 18,775 Operating loss (266) (1,012) Finance expenses 349 180 Other income 123 241 Loss before income taxes (492) (951) Income tax expense (recovery) (272) 275 Current (151) Deferred 233 (39) 124 $ (453) $ (1,075) Net loss and comprehensive loss Net loss per share Basic and diluted $ (0.07) $ (0.16) Basic and diluted 10 As at December 30 Note 2016 2015 ASSETS Non-current assets Property, plant and equipment $ 45,999 $ 42,608 11 Intangible assets 12 336 456 46,335 43,064 Current Land held for sale 13 1,819 Inventories 14 5,144 4,935 Accounts receivable 15, 26 1,294 2,221 Prepaid expenses and deposits 16 410 555 Cash 207 540 8,874 8,251 Total assets $ 55,209 $ 51,315 LIABILITIES AND SHAREHOLDERS' EQUITY EQUITY Shareholders' capital 17 $113,121 $113,121 Contributed surplus 18 1,438 1,255 Accumulated deficit (77,289) (76,836) 37,270 37,540 LIABILITIES Non-current Long term debt 19 5,339 3,485 Share-based payment liabilities 18 336 134 Lease incentive liability 20 186 181 Deferred income taxes 9. 4,632 4,399 10,493 8,199 Current Accounts payable and accrued liabilities 21, 26 3,937 3,870 Current taxes payable 55 Current portion of long term debt 19 662 404 Bank indebtedness 19 2,843 1,247 7,446 5,576 Total liabilities and shareholders' equity $ 55,209 $ 51,315 As at December 30 Note 2016 2015 ASSETS Non-current assets Property, plant and equipment $ 45,999 $ 42,608 11 Intangible assets 12 336 456 46,335 43,064 Current Land held for sale 13 1,819 Inventories 14 5,144 4,935 Accounts receivable 15, 26 1,294 2,221 Prepaid expenses and deposits 16 410 555 Cash 207 540 8,874 8,251 Total assets $ 55,209 $ 51,315 LIABILITIES AND SHAREHOLDERS' EQUITY EQUITY Shareholders' capital 17 $113,121 $113,121 Contributed surplus 18 1,438 1,255 Accumulated deficit (77,289) (76,836) 37,270 37,540 LIABILITIES Non-current Long term debt 19 5,339 3,485 Share-based payment liabilities 18 336 134 Lease incentive liability 20 186 181 Deferred income taxes 9. 4,632 4,399 10,493 8,199 Current Accounts payable and accrued liabilities 21, 26 3,937 3,870 Current taxes payable 55 Current portion of long term debt 19 662 404 Bank indebtedness 19 2,843 1,247 7,446 5,576 Total liabilities and shareholders' equity $ 55,209 $ 51,315