(Calculate the amount of goodwill, LO 1) On April 15, 2003 Cashtown Inc. (Cashtown) purchased 100% of...

Question:

(Calculate the amount of goodwill, LO 1) On April 15, 2003 Cashtown Inc.

(Cashtown) purchased 100% of the common shares of Shakespeare Ltd.

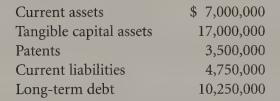

(Shakespeare) for $16,000,000. At the time of the purchase, Cashtown’s management made the following estimates of the fair values of Shakespeare’s assets and liabilities:

Required:

a. Calculate the amount of goodwill that Cashtown recorded when it purchased Shakespeare on April 15, 2003.

b. In fiscal 2007, management determined that the goodwill associated with the purchase of Shakespeare was impaired and that it should be written down to $2,500,000. Prepare the journal entry that Cashtown would make to the consolidated financial statements to record the impairment of the goodwill. What amount would be reported on the fiscal 2007 balance sheet for goodwill and what expense would be reported in the income statement?

Step by Step Answer: