(Calculating missing information about balance sheet accounts, LO 4) The following general equation can be used to...

Question:

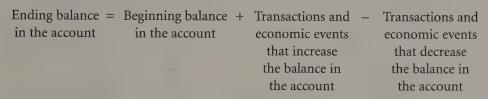

(Calculating missing information about balance sheet accounts, LO 4) The following general equation can be used to determine missing information about balance sheet accounts:

Use the equation to determine the missing information in each of the following independent situations. For each case assume that the year end is June 30.

a. On July 1, 2004 Zincton Ltd. (Zincton) had $325,000 of Inventory on hand.

During fiscal 2005 Zincton sold $980,000 of Inventory and purchased $815,000 of inventory. How much inventory did Zincton have on June 30, 2005?

b. On July 1, 2003 Winsloe Inc. (Winsloe) had $370,000 of Accounts Receivable and on June 30, 2004 it had $420,000 of accounts receivable. During fiscal 2004 Winsloe collected $2,150,000 from customers. What amount of credit sales did Winsloe make during fiscal 2004? Assume all of Winsloe’s sales were on credit.

c. Union Inc. (Union) capitalizes its store opening costs and amortizes them over five years. On July 1, 2004 the balance in Union’s unamortized Store Opening Costs account on the balance sheet was $115,000. On June 30, 2005 the balance in the account was $95,000. During fiscal 2005 the amortization expense for store opening costs was $30,000. What amount of store opening costs did Union capitalize to the Store Opening Costs account on the balance sheet during fiscal 2005? Assume that Union does not have a separate contra-asset account for accumulating amortization for this account.

d. On June 30, 2004 Sawbill Ltd. (Sawbill) owed its employees $152,000. During fiscal 2004, Sawbill’s employees earned $1,250,000 and were paid $1,120,000.

How much did Sawbill owe its employees on July 1, 2003?

e. Otter Inc. (Otter) purchases all of its inventory on credit. On July 1, 2004 Otter had $250,000 of Inventory on hand and on June 30, 2005 it had $200,000 of Inventory. Cost of Goods Sold during fiscal 2005 was $950,000. The beginning and ending balances in Otter’s Accounts Payable account on July 1, 2004 and June 30, 2005 were $135,000 and $103,000 respectively. How much did Otter pay its suppliers during fiscal 2005?

Step by Step Answer: