(Calculation of income using transfer pricing) Enchanting Scents Ltd. manufactures a line of perfume in a series...

Question:

(Calculation of income using transfer pricing) Enchanting Scents Ltd. manufactures a line of perfume in a series of mixing operations with the addition of certain aromatic and coloring ingredients. The finished products are packaged in a company-produced glass bottle and packed in cases containing six bottles.

Management believes that product sales are heavily influenced by the ap¬ pearance of the bottle and has therefore devoted considerable effort to the bottle production process. This attention has resulted in the development of certain unique bottle production processes in which management takes considerable pride.

The two areas (perfume production and bottle manufacturing) have evolved over the years in an almost independent manner; in fact, rivalry has developed between management personnel about which division is more important to En¬ chanting Scents. This attitude is probably intensified because the bottle manu¬ facturing plant was purchased intact 10 years ago and no real interchange of management personnel or ideas (except at the top corporate level) has taken place.

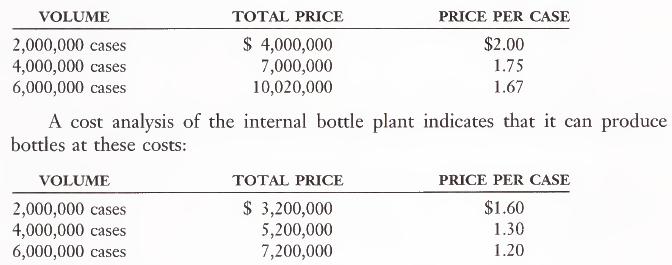

Since the Bottle Division was acquired, its entire production has been ab¬ sorbed by the Perfume Division. Each area is considered a separate profit center and evaluated as such. As the new corporate controller, you are responsible for the definition of a proper transfer price to use in crediting the bottle production profit center and in debiting the perfume production profit center. At your re¬ quest, the general manager of the Bottle Division has asked certain other bottle manufacturers to quote a price for the quantity and sizes demanded by the Per¬ fume Division. These competitive prices for cases of six bottles each are as follows:

The above analysis represents fixed costs of $1,200,000 and variable costs of $1 per case.

These figures have given rise to considerable corporate discussion about the proper value to use in the transfer of bottles to the Perfume Division. This interest is heightened because a significant portion of a division manager’s in¬ come is an incentive bonus based on profit center results.

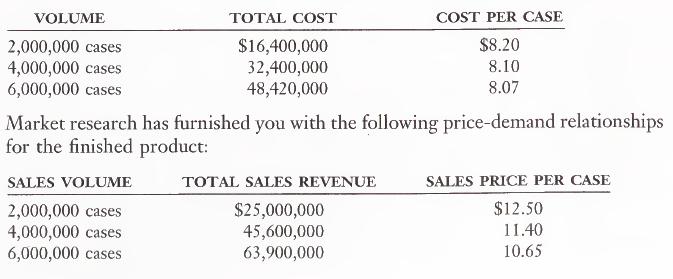

The Perfume Division has the following costs in addition to the bottle costs:

a. Enchanting Scents Ltd. has used market-based transfer prices in the past. Using the current market prices and costs, and assuming a volume of 6,000,000 cases, calculate the income for the Bottle Division, the Perfume Division, and Enchanting Scents Ltd.

b. The production and sales level of 6,000,000 cases is the most profitable vol¬ ume for which of the following: the Bottle Division, the Perfume Division, or Enchanting Scents? Explain your answer.

(IMA adapted)

Step by Step Answer: