Company A purchased a certain number of Company B's outstanding voting shares at S18 per share as

Question:

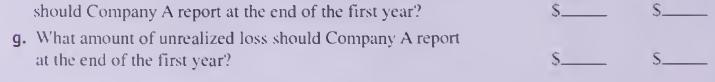

Company A purchased a certain number of Company B's outstanding voting shares at S18 per share as a long-term investment. Company B had outstanding 20.000 shares of S10 par value stock. Complete the following matrix relating to the measurement and reporting by Company A after acquisition of the shares of Company B stock.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: