Company C had outstanding 30,000 shares of common stock, par value $10 per share. On January 1,

Question:

Company C had outstanding 30,000 shares of common stock, par value $10 per share. On January 1, 2003, Company D purchased some of these shares as a long-term investment at $25 per share. At the end of 2003, Company C reported the following: income, $50,000, and cash dividends declared and paid during the year, $25,500. The market value of Company C stock at the end of 2003 was $22 per share.

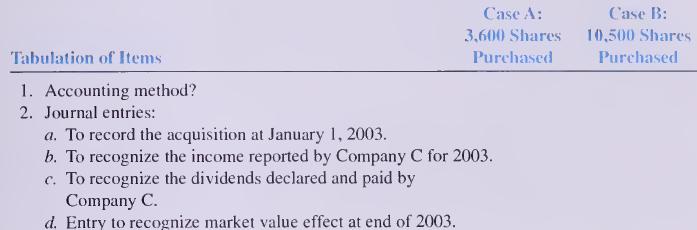

Required: 1. For each of the following cases (in the tabulation), identify the method of accounting that Company D should use. Explain why. 2. Give the journal entries for Company D at the dates indicated for each of the two independent cases, assuming that the investments will be held long term. If no entry is required, explain why.

Use the following format:

Step by Step Answer: