(Decisions based on ROI, RI) Seattle Aviation evaluates the performance of its two division managers using an...

Question:

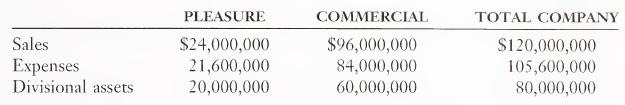

(Decisions based on ROI, RI) Seattle Aviation evaluates the performance of its two division managers using an ROI formula. For the forthcoming period, divisional estimates of relevant measures are

The managers of both operating divisions have the autonomy to make de¬ cisions regarding new investments. The manager of Pleasure Crafts is contem¬ plating an investment in an additional asset that would generate an ROI of 14 percent, and the manager of Commercial Crafts is considering an investment in an additional asset that would generate an ROI of 18 percent.

a. Compute the projected ROI for each division disregarding the contemplated new investments.

b. Based on your answer in part

a, which of the managers is likely to actually invest in the additional assets under consideration?

c. Are the outcomes of the investment decisions in part b likely to be consistent with overall corporate goals? Explain.

d. If the company evaluated the division managers’ performances using a resid¬ ual income measure with a target return of 17 percent, would the outcomes of the investment decisions be different from those described in part b? Explain.

Step by Step Answer: