DHX Media Inc. is a Halifax-based developer, producer, and distributor of films and television programs. Excerpts from

Question:

DHX Media Inc. is a Halifax-based developer, producer, and distributor of films and television programs. Excerpts from the company’s financial statements for the year ended June 30, 2016, are in Exhibits 2.22A to 2.22C.

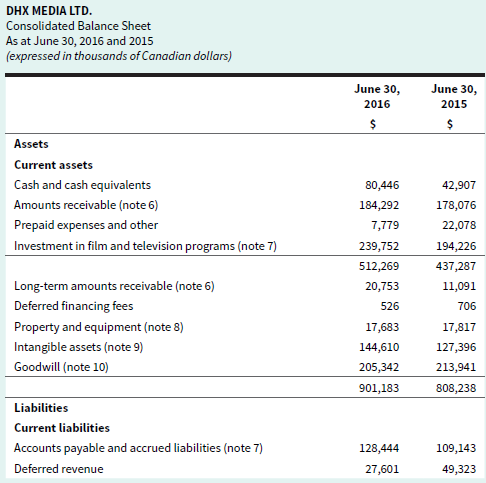

EXHIBIT 2.22A DHX Media Ltd.’s 2016 Consolidated Balance Sheet

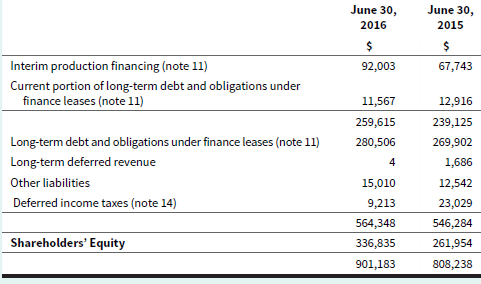

EXHIBIT 2.22B DHX Media Ltd.’s 2016 Consolidated Statement of Income

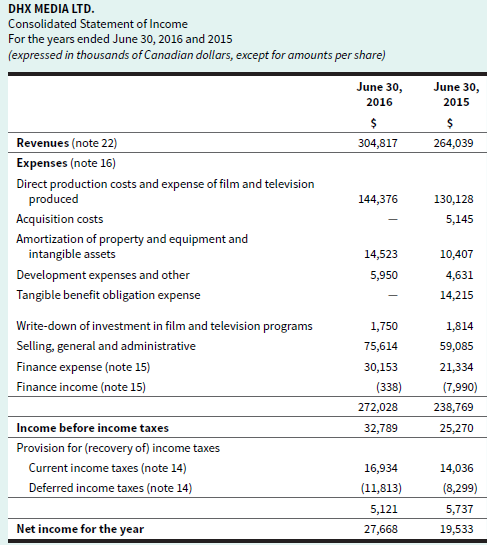

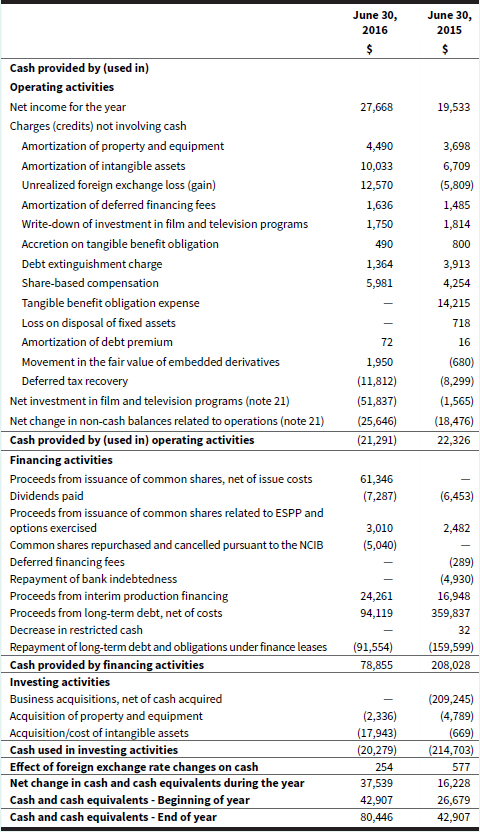

EXHIBIT 2.22C DXH Media Ltd.’s 2016 Consolidated Statement of Cash Flows

Required

a. How much cash did DHX have available to use at the end of fiscal 2016?

b. What percentage of DHX’s assets were financed by shareholders in 2016? Did this represent an increase or decrease relative to 2015? What does this change mean?

c. How much did DHX’s accounts receivable increase from 2015 to 2016? How did this compare with the change in revenues during the same period? What does this tell you?

d. Determine direct production costs and expense of film and television programs produced as a percentage of DHX’s revenues in 2016. How did this compare with 2015? Do the same analysis for selling, general, and administrative expenses. Comment on what these trends tell you about the company.

e. Did the company pay dividends during fiscal 2016? How did you determine this?

f. How much property and equipment did DHX acquire in 2016? How did this compare with the proceeds it received from the sale of property and equipment during the year?

g. Calculate the following ratios for fiscal 2016 and 2015. (Note that, in order to be able to calculate these ratios for each of the years, you will have to use the total assets for each year and the total shareholders’ equity for each year in your ratios, rather than average total assets and average shareholders’ equity.)

i. Profit margin ratio

ii. Return on assets

iii. Return on equity

h. Comment on your results in part “g.”

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Accounts Receivable

Accounts receivables are debts owed to your company, usually from sales on credit. Accounts receivable is business asset, the sum of the money owed to you by customers who haven’t paid.The standard procedure in business-to-business sales is that...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley