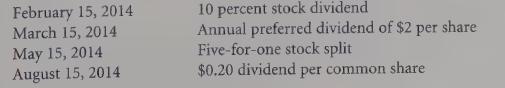

During the year ended November 30, 2014 Aguanish Inc. (Aguanish) reported the following equity events: The equity

Question:

During the year ended November 30, 2014 Aguanish Inc. (Aguanish) reported the following equity events:

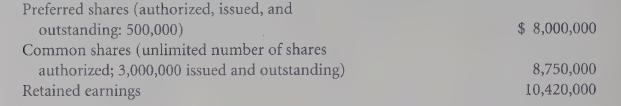

The equity section of Aguanish’s balance sheet on November 30, 2013, was as follows:

Net income for fiscal 2014 was \($6,500,000\). In previous years, Aguanish paid its common shareholders annual dividends of \($1\) per share.

Required:

a. Prepare Aguanish’s shareholders’ equity section on November 30, 2014.

b. Calculate basic earnings per share for fiscal 2014. What would EPS have been had the stock split and stock dividend not occurred?

c. As an Aguanish shareholder, what is your reaction to the reduction in the per share dividend from \($5\) per share to \($1\) per share?

d. The market value of Aguanish’s shares on November 30, 2014 was \($120\) per share.

What do you estimate the market price of the shares would have been had the stock dividend and stock split not occurred? Explain your answer.

e. Calculate Aguanish’s price-to-book ratio on November 30, 2014. What would the price-to-book ratio have been had the stock split and stock dividend not occurred?

Explain your answer.

Step by Step Answer: