(Evaluating accounts payable management, LO 2) Guisachan Books Inc. (Guisachan) is a small book retailer. Guisachan has...

Question:

(Evaluating accounts payable management, LO 2) Guisachan Books Inc.

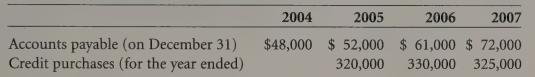

(Guisachan) is a small book retailer. Guisachan has approached your company, a large publishing house, requesting credit terms on purchases. Guisachan has never purchased from your company. If credit is approved, Guisachan would be given 60 days to pay outstanding amounts. You have been provided with the following information from Guisachan’s accounting records:

Required:

a. Calculate Guisachan’s accounts payable turnover ratio for 2005, 2006, and 2007.

b. Calculate Guisachan’s average payment period for accounts payable for 2005, 2006, and 2007.

c. Assume you are the credit manager of the large publishing house. How would you interpret the information you received about Guisachan’s accounts payable? How would this information influence your decision about whether to offer credit to Guisachan? Explain. What additional information would you request before making a final decision? Explain.

d. What effect will the results you calculated in parts

(a) and

(b) have on Guisachan’s cash from operations? Explain. Is this a good situation? Explain.

How might Guisachan’s suppliers respond? Explain.

Step by Step Answer: