(Evaluating accounts receivable, LO 2) Oungre Inc. (Oungre) is a small printing business that provides a wide...

Question:

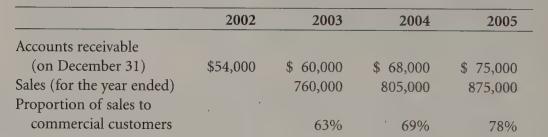

(Evaluating accounts receivable, LO 2) Oungre Inc. (Oungre) is a small printing business that provides a wide range of printing services to retail and commercial clients. Retail customers pay cash, while Oungre offers its commercial customers 30 days from the delivery date to pay amounts owing. You have been provided with the following information from Oungre’s accounting records:

Required:

a. Calculate Oungre’s accounts receivable turnover ratio for 2003, 2004, and 2005.

b. Calculate Oungre’s average collection period of accounts receivable for 2003, 2004, and 2005.

c. Assess how well Oungre is managing its accounts receivable over the three-year period.

d. What are some possible explanations for why Oungre’s collection is not less than 30 days? What stepsmight Oungre’s management take to reduce the col- lection period further?

e. Suppose you did not know what the proportion of Oungre’s sales to commercial customers was. How would your calculation of the accounts receivable turnover ratio and the average collection period of accounts receivable be affected? How would your interpretation of the performance of Oungre’s man- agement be affected?

Step by Step Answer: