(Evaluating liquidity and solvency, LO 2) Yekooche Inc. (Yekooche) is a small manufacturer of home environmental products...

Question:

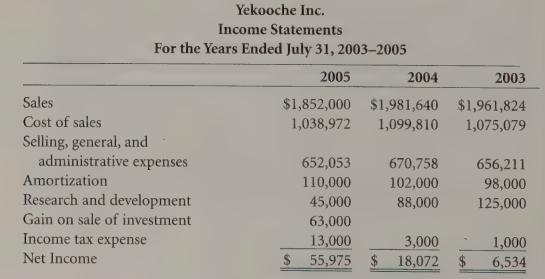

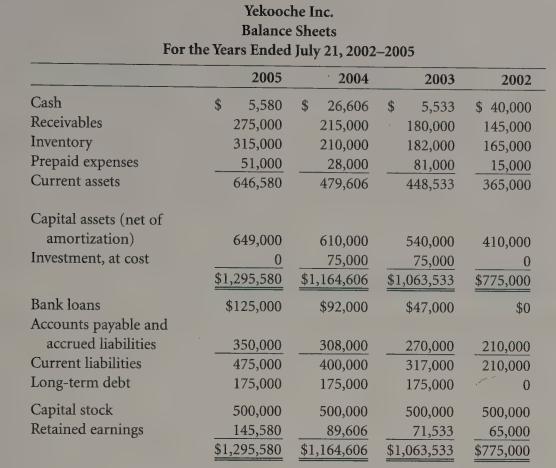

(Evaluating liquidity and solvency, LO 2) Yekooche Inc. (Yekooche) is a small manufacturer of home environmental products such as humidifiers, air cleaners, and ionizers. Yekooche’s products are sold across Canada and about 20% of its sales are outside of Canada, mainly in the United States. The president of Yekooche feels that the company has a good product and established markets, and has performed well over the last few years. However, the president is concerned that Yekooche is chronically tight on cash, She has approached your organization for a significant loan to provide the company with additional working capital, as well as to purchase capital assets that need to be replaced. The president of Yekooche has provided income statements and balance sheets for recent years.

Additional information:

e The long-term debt is due to be repaid in early 2007. The amount is owed to a large bank and is secured against certain capital assets.

e Yekooche has a $130,000 line of credit available from its bank. Bank loans represent the amount borrowed against the line of credit.

e All sales to customers and purchases of inventory are made on credit.

e Interest expense is included in selling, general, and administrative expenses.

Interest expense was $31,000 in 2005, $25,500 in 2004, and $12,000 in 2003.

Required:

Prepare a report to the corporate lending department evaluating the liquidity and solvency of Yekooche. Provide a preliminary recommendation on whether the loan should be made. Provide support for your recommendation. What additional information would you want before reaching a final decision on the loan application? In your analysis consider Yekooche’s cash flow.

Step by Step Answer: