Foymount Industries Inc. borrowed $800,000 from Development Bank to finance the purchase of equipment costing $650,000 and

Question:

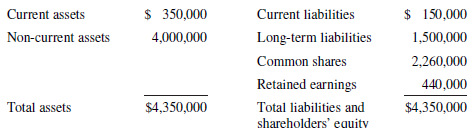

Foymount Industries Inc. borrowed $800,000 from Development Bank to finance the purchase of equipment costing $650,000 and to provide $150,000 in cash. The legal documentation states that the loan matures in 20 years, and the principal is to be paid in annual instalments of $40,000. The terms of the loan also indicate that Foymount must maintain a current ratio of 2.5 and cannot pay dividends that will reduce retained earnings below $375,000. The statement of financial position, immediately prior to the bank loan and the purchase of equipment, follows:

Required

In the fiscal year ended 2020, the board of directors would like to declare a dividend to be paid to shareholders early in the next year. After accepting the loan and purchasing the equipment, how large a dividend can Foymount’s board of directors pay and not be in breach of the terms of the loan?

DividendA dividend is a distribution of a portion of company’s earnings, decided and managed by the company’s board of directors, and paid to the shareholders. Dividends are given on the shares. It is a token reward paid to the shareholders for their...

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley