(Future income taxes, LO 7) Use the following information to calculate the balance in the future income...

Question:

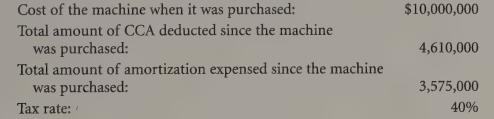

(Future income taxes, LO 7) Use the following information to calculate the balance in the future income tax account for a building owned by the entity:

Transcribed Image Text:

Cost of the machine when it was purchased: $10,000,000 Total amount of CCA deducted since the machine was purchased: 4,610,000 Total amount of amortization expensed since the machine was purchased: 3,575,000 Tax rate: 40%

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Asim farooq

I have done MS finance and expertise in the field of Accounting, finance, cost accounting, security analysis and portfolio management and management, MS office is at my fingertips, I want my client to take advantage of my practical knowledge. I have been mentoring my client on a freelancer website from last two years, Currently I am working in Telecom company as a financial analyst and before that working as an accountant with Pepsi for one year. I also join a nonprofit organization as a finance assistant to my job duties are making payment to client after tax calculation, I have started my professional career from teaching I was teaching to a master's level student for two years in the evening.

My Expert Service

Financial accounting, Financial management, Cost accounting, Human resource management, Business communication and report writing. Financial accounting : • Journal entries • Financial statements including balance sheet, Profit & Loss account, Cash flow statement • Adjustment entries • Ratio analysis • Accounting concepts • Single entry accounting • Double entry accounting • Bills of exchange • Bank reconciliation statements Cost accounting : • Budgeting • Job order costing • Process costing • Cost of goods sold Financial management : • Capital budgeting • Net Present Value (NPV) • Internal Rate of Return (IRR) • Payback period • Discounted cash flows • Financial analysis • Capital assets pricing model • Simple interest, Compound interest & annuities

4.40+

65+ Reviews

86+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Required: Use the following information to complete Paul and Judy Vances 2011 federal income tax return. If information is missing, use reasonable assumptions to fill in the gaps. You may need the...

-

can any expert help me with the below assignment just only 2 questions ,please read the requirment word by word and be careful about the style of the reference(APA) , file 3.1 is for question...

-

just only 2 questions ,please read the requirment word by word and be careful about the style of the reference(APA) , file 3.1 is for question 2..BTW,please focus the every step FINANCE SPOTLIGHT...

-

What are the roles and responsibilities of civil society in relation to the Sustainable Development Goals? In your country, how has civil society been engaged in the dialogue or discussion on...

-

With electricity, we saw that it was important to tax the pollutant rather than the final product itself. In the following cases, will the proposed taxes actually hit at the source of the external...

-

Younie Corporation has two divisions: the South Division and the West Division. The corporation's net operating income is $95,700. The South Division's divisional segment margin is $44,300 and the...

-

7. Eastover Company (EO) is a large, diversified forest products company. Approximately 75% of its sales are from paper and forest products, with the remainder from financial services and real...

-

The Stone River Textile Mill was inspected by OSHA and found to be in violation of a number of safety regulations. The OSHA inspectors ordered the mill to alter some existing machinery to make it...

-

In January of 20X1, the Phillips Company purchased a patent at a cost of $100,000. In addition, $10,000 in legal fees were paid to acquire the patent. The company estimated a 10-year useful life for...

-

(Future income taxes, LO 7) For the fiscal year ended November 30, 2004 Vibank Ltd. (Vibank) has income before taxes of $4,500,000. Vibanks tax return shows taxable income of $4,950,000 for that...

-

(Future income taxes, LO 7) Use the following information to calculate the balance in the future income tax account for a machine owned by the entity: Cost of the machine when it was purchased:...

-

An aluminum bar 125 mm (5.0 in.) long and having a square cross section 16.5 mm (0.65 in.) on an edge is pulled in tension with a load of 66,700 N (15,000 lbf) and experiences an elongation of 0.43...

-

Part 1 - Financial Statement Analysis Income Statement Kirks Family Restaurant December 31, 2018 Sales 480,000 Interest revenue 15,000 Total Revenue 495,000 Cost of goods sold 200,000 Gross Margin...

-

Find the most general value of satisfying tan 0 = -3.

-

(i) Undercasting of the debit side of Bank column. 70 (ii) Cheques issued but not presented for payment till 01-01-2011. 1,450 (1,520) 2,179 Bank Balance as per Pass Book as on 1-1-2011. Different...

-

Determine the stiffness matrix K for the truss. Take A = 0.0015 m^2 and E = 200 GPa for each member. Please show the step-by-step solution. 5 410 9 3 5 7 7 8 A4 Tesol242 3 2 4 4 5 6 2 4 m 4 m 20 kN...

-

Probability Mr Pandazis Practice Questions for Test #1 Math 241 1. Define a sample space S for the following experiment. Toss a coin three times and record the outcome for each toss. 2. A card is...

-

Country Fruit Stand orders eighty cases of peaches from Down Home Farms. Without stating a reason, Down Home untimely delivers thirty cases instead of eighty. Does Country have the right to reject...

-

In each of the following independent cases, document the system using whatever technique(s) your instructor specifies. a. Dreambox Creations (www.dreamboxcreations.com/) in Diamond Bar, California,...

-

Collect five years of weekly data for ten different stocks. Use this data to trace out the efficient frontier, and draw the capital allocation line.

-

If an equity analyst can correctly and consistently predict whether a company will surprise positively or negatively, why is it still challenging to guarantee making money for clients each quarter?...

-

Analyzing and Interpreting Restructuring Costs and Effects Smith - Burke, Inc., reports the following footnote disclosure ( excerpted ) in its 2 0 1 0 1 0 - K relating to its restructuring programs....

Study smarter with the SolutionInn App