(Hybrid securities, LO 2) In May 2005 Kugluktuk Ltd. (Kugluktuk) sold $200,000 in convertible bonds to investors....

Question:

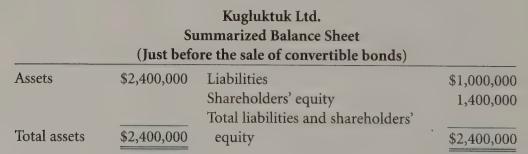

(Hybrid securities, LO 2) In May 2005 Kugluktuk Ltd. (Kugluktuk) sold $200,000 in convertible bonds to investors. The bonds have a coupon rate of 9% and mature in May 2015. The bonds are convertible into common shares at the option of the company. The terms of the bond agreement make it highly likely that the bonds will be converted before they mature. Kugluktuk’s summarized balance sheet just before the convertible bonds were sold was:

Required:

a. Do you think that the convertible bonds are really debt or equity? Explain.

(Consider the characteristics of debt and equity in your response.)

b. Prepare the journal entry to record the issuance of the convertible bond and calculate the resulting debt-to-equity ratio, assuming that the bonds are classified as debt.

c. Prepare the journal entry to record the issuance of the convertible bond and calculate the resulting debt-to-equity ratio, assuming that the bonds are classi- fied as equity.

d. How do you think Kugluktuk’s management would want to classify the convertible bonds for accounting purposes? Explain.

e. How do you think Kugluktuk’s management would want to classify the convertible bonds for tax purposes? Explain.

f. How do you think Kugluktuk’s management would account for the convertible bonds if the classification for tax purposes had to be the same as the classification for accounting purposes?

g. Does it matter how the convertible bonds are classified? Explain.

Step by Step Answer: