Indicate whether each of the following events would be included in a calculation of net income on

Question:

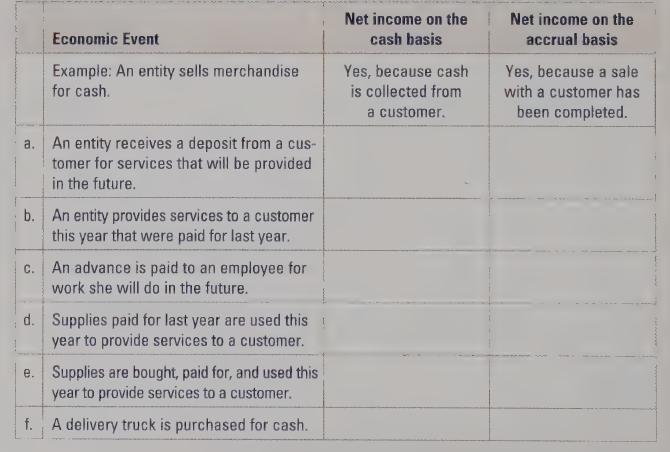

Indicate whether each of the following events would be included in a calculation of net income on the cash basis, the accrual basis, or both. Provide a brief explanation for your treatment:

Transcribed Image Text:

a. Economic Event Example: An entity sells merchandise for cash. An entity receives a deposit from a cus- tomer for services that will be provided in the future. b. An entity provides services to a customer this year that were paid for last year. C. An advance is paid to an employee for work she will do in the future. d. Supplies paid for last year are used this year to provide services to a customer. e. Supplies are bought, paid for, and used this year to provide services to a customer. f. A delivery truck is purchased for cash. Net income on the cash basis Yes, because cash is collected from a customer. Net income on the accrual basis Yes, because a sale with a customer has been completed.

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Answer rating: 100% (QA)

Answered By

Mehwish Aziz

What I have learnt in my 8 years experience of tutoring is that you really need to have a friendly relationship with your students so they can come to you with their queries without any hesitation. I am quite hardworking and I have strong work ethics. Since I had never been one of those who always top in the class and always get A* no matter what, I can understand the fear of failure and can relate with my students at so many levels. I had always been one of those who had to work really hard to get decent grades. I am forever grateful to some of the amazing teachers that I have had who made learning one, and owing to whom I was able to get some extraordinary grades and get into one of the most prestigious universities of the country. Inspired by those same teachers, I am to be like one of them - who never gives up on her students and always believe in them!

5.00+

3+ Reviews

10+ Question Solved

Related Book For

Question Posted:

Students also viewed these Business questions

-

Indicate whether each of the following events would be included in a calculation of net income on the cash basis, the accrual basis, or both. Provide a brief explanation for your treatment. Remember...

-

Working on a final paper evaluating General Motors Co, corporate performance. Attached is the outline of the assignment along with GM financial annual statement. Evaluation of Corporate Performance...

-

I need Chapter 2 & 3 finished. Chapter 4 & 5, Chapter 6 & 7, & Chapter 8. Some of this is completed, but it isn't 100% finished. Let me know if you can get to it. Personal Finance, Fifth Edition by...

-

Wealthy Manufacturing Company purchased 40 percent of the voting shares of Diversified Products Corporation on March 23, 20X4. On December 31, 20X8, Wealthy Manufacturings controller attempted to...

-

What arguments would there be for and against Sunseeker changing its long-standing strategy to, for example: a. Compete more aggressively at the budget end of the market? b. Concentrate on Europe or...

-

Ozone, O 3 , in the Earths upper atmosphere decomposes according to the equation The mechanism of the reaction is thought to proceed through an initial fast, reversible step followed by a slow,...

-

What is the difference between an organizations business and its goals? LO.1

-

Assume you complete tax returns for clients. You were engaged to file the 2013 individual and corporate tax returns for a client. The client provided her records and other tax information to you on...

-

: Marvel Parts, Inc., manufactures auto accessories. One of the company's products is a set of seat covers that can be adjusted to fit nearly any small car. The company has a standard cost system in...

-

A handful of businesspersons who have earned billions of dollars stand ready to, or already have, purchased a professional sports team. To what extent do you think emotions influenced their decision...

-

Can you give an example of an outstandingly successful decision in business? Explain why you consider the decision to be an outstanding success.

-

Multiple Choice Questions 1. Which of the following ratios is used to measure a firms efficiency? a. Net Income Equity b. Net Sales Average Total Assets c. Assets Equity d. Net Income Sales 2....

-

The employee.class.php file contains an abstract, base class named Employee . One of the attributes of the class is an object of Person . This demonstrates one of the three relationship types among...

-

A direct shear test is performed on a saturated specimen of loose sand. A normal stress equal to 100 kPa is applied and a maximum shear stress of 75 kPa is measured in the shear test. Determine the...

-

How does budgeting help managers? Budgeting helps managers determine if their goals are ethical and achievable. Budgeting helps managers determine if their goals are reasonable and achievable....

-

If the 230-lb block is released from rest when the spring is unstretched, determine the velocity of the block after it has descended 5ft . The drum has a weight of 70lb and a radius of gyration of...

-

A B C D E F 1 Frequency : Monthly 2 Loan Amount: 150000.00 3 Interest Rate: 7.25% 4 Term(years): 30.00 5 No. of payments in a year: 12 time(s) 6 Periodic Rate: 0.60% =C3/C5 7 Total number of payment:...

-

Paris Jewelry Company reported the following summarized balance sheet at December 31, 2012: During 2013, Paris completed these transactions that affected stockholders equity: Requirements 1....

-

Refer to the Conservation Ecology (Dec. 2003) study of the causes of forest fragmentation, presented in Exercise 2.166 (p. 97). Recall that the researchers used advanced high-resolution satellite...

-

A firm purchased a new piece of equipment with an estimated useful life of eight years. The cost of the equipment was $65,000. The salvage value was estimated to be $10,000 at the end of year 8....

-

5. Which of the following is the cheapest for a borrower? a. 6.7% annual money market basis b. 6.7% semi-annual money market basis c. 6.7% annual bond basis d. 6.7% semi-annual bond basis.

-

Waterloo Industries pays 30 percent corporate income taxes, and its after-tax MARR is 24 percent. A project has a before-tax IRR of 26 percent. Should the project be approved? What would your...

Study smarter with the SolutionInn App