(Inventory cost flow assumptions when prices are falling, LO 2, 3) Azilda Inc. (Azilda) operates in a...

Question:

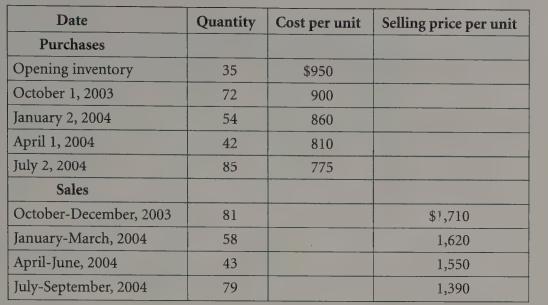

(Inventory cost flow assumptions when prices are falling, LO 2, 3) Azilda Inc. (Azilda) operates in a part of the computer industry where the cost of inventory has been falling recently. The cost of inventory purchased by Azilda over the last year is summarized on page 483. Azilda values its inventory at the lower of cost and mar- ket and defines market as net realizable value. Assume that purchases are made at the start of a month before any sales occur during that month.

Required:

a. Calculate cost of sales for the year ended September 30, 2004 and ending inventory on September 30, 2004 for Azilda using the FIFO, average cost, and LIFO cost flow assumptions.

b. Which cost flow assumption is most attractive for an accounting objective of income maximization?

c. Which cost flow assumption is most attractive for an accounting objective of tax minimization?

d. Compare the relative values under the three cost flow assumptions of ending inventory and cost of sales in this situation versus a situation where prices are rising. What is different between the two situations?

e. Apply the lower of cost and market rule to the year-end inventory. Assume that Azilda’s selling costs for inventory are $300 per unit.

Step by Step Answer: