Kapuskasing Inc. (Kapuskasing) imports widgets from China for sale in the Canadian market. You are provided with

Question:

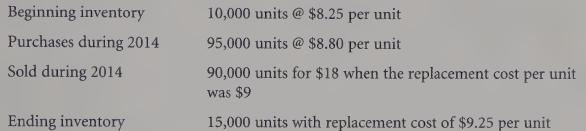

Kapuskasing Inc. (Kapuskasing) imports widgets from China for sale in the Canadian market. You are provided with the following information about Kapuskasing’s inventory for 2014:

In addition, Kapuskasing incurred $125,000 in other costs to operate its business. The company’s year-end is December 31.

Required

a. Prepare an income statement for Kapuskasing for 2014. Show the gross margin and net income for the year on your income statement. Assume that Kapuskasing uses FIFO to account for its inventory.

b. Prepare an income statement for Kapuskasing for 2014 assuming that it values its inventory at replacement cost. Prepare the journal entries you require to record the ending inventory at replacement cost at the end of 2014.

c. What amount would be reported on the December 31, 2014 balance sheet for inventory if i. Kapuskasing uses FIFO to value its inventory?

ii. Kapuskasing uses replacement cost to value its inventory?

d. Explain the differences between the two income statements you prepared. How would a stakeholder interpret these income statements?

Step by Step Answer: