Longueuil Ltd. (Longueuil) is a small manufacturer of shirts in Qubec. Longueuil recently obtained financing from a

Question:

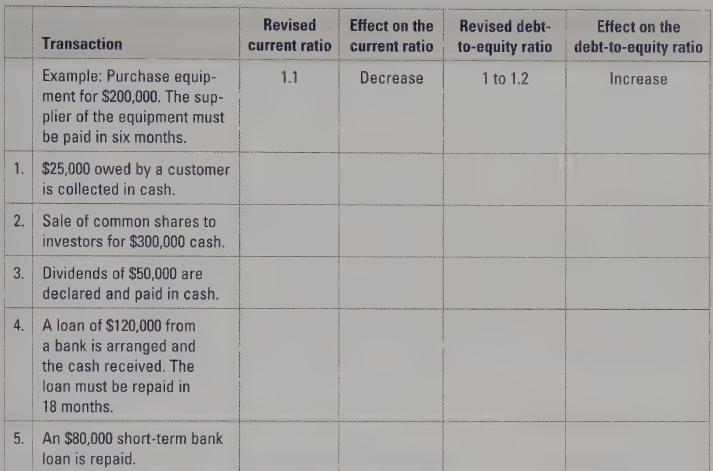

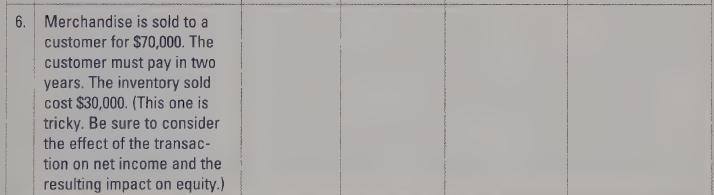

Longueuil Ltd. (Longueuil) is a small manufacturer of shirts in Québec. Longueuil recently obtained financing from a local bank for an expansion of the company’s facilities. The agreement with the bank requires that Longueuil’s current ratio and debt-to-equity ratio be within ranges stated in the agreement. If the ratios fall outside of these ranges Longueuil would have to repay the new loans immediately. At this time Longueuil has a current ratio of 1.5 (based on current assets of \($900,000\) and current liabilities of

$600,000) and a debt-to-equity ratio of 1 to 1 (based on total liabilities of \($1.2\) million and total equity of \($1.2\) million). The chief financial officer of Longueuil is concerned about the effect a number of transactions that will be occurring in the last few days of the year will have on the company’s current ratio and debt-to-equity ratio.

Required:

Determine the effect that each of the following transactions will have on the initial current ratio and debt-to-equity ratio. Calculate what each ratio will be after each transaction takes place and state the effect each transaction has on the ratios (increase, decrease, or no effect). Treat each item independently.

Step by Step Answer: