Lucknow Ltd. (Lucknow) is a public company manufacturing casings for electronic equipment. Recently, the board of directors

Question:

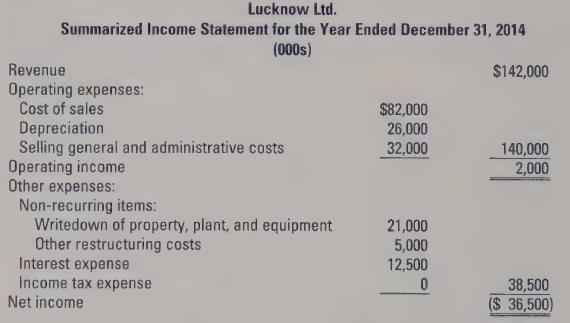

Lucknow Ltd. (Lucknow) is a public company manufacturing casings for electronic equipment. Recently, the board of directors replaced management because it was felt the company was underperforming. The new management team undertook a major restructuring of the company that included a $21,000,000 writedown of property, plant, and equipment and intangibles as well as $5,000,000 in severance and related costs. The written-down assets will continue to be used. The restructuring is reported separately in Lucknow’s income statement as a “non-recurring” item and isn’t included in the calculation of operating income. In addition, Lucknow wrote down its inventory in fiscal 2014 by $1,000,000. The amount is included in cost of sales.

Lucknow’s summarized income statement for the year ended December 31, 2014 is as follows:

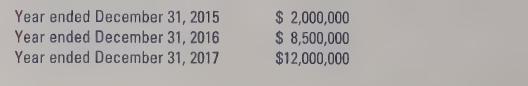

The writedowns will reduce the depreciation expense by $3,000,000 per year for each of the next seven years, beginning in fiscal 2015. After the announcement and release of the income statement, analysts revised their forecasts of earnings for the next three years to:

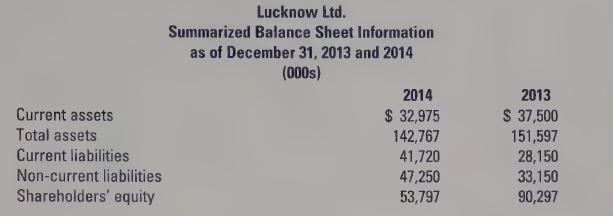

You also obtained the following information from Lucknow’s December 31, 2013 and 2014 balance sheets:

Required:

a. What would net income be in each of 2014 through 2017 had Lucknow not written off the assets but continued to depreciate them? Assume Lucknow’s operations of don’t change regardless of the accounting method used? Interpret the differences in net income under the two scenarios. Use the analysts’ forecasts to determine net income. Ignore the impact of taxes.

b. What would Lucknow’s gross margin percentage, profit margin ratio, debt-toequity ratio, return on assets, and return on equity be in 2014 assuming (i) that the assets had been written off and (ii) assuming that the assets had not been written off and they were continuing to be depreciated. Interpret the results under each assumption.

c. How would the writedowns in 2014 affect Lucknow’s gross margin percentage, profit margin ratio, debt-to-equity ratio, return on assets, and return on equity in 2015 through 2017? How is your ability to analyze and interpret the financial statements affected?

Step by Step Answer: