Maple Leaf Foods Inc. is a producer of food products under leading brands including Maple Leaf, Maple

Question:

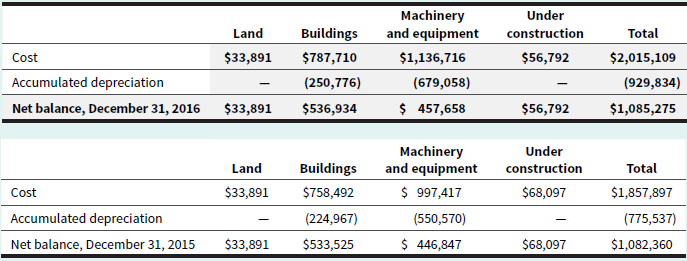

Maple Leaf Foods Inc. is a producer of food products under leading brands including Maple Leaf, Maple Leaf Prime, Schneiders, and Country Natural. Exhibit 8.26 is an extract from Maple Leaf’s consolidated financial statements for the year ended December 31, 2016:

EXHIBIT 8.26 Extract from Maple Leafs Foods Inc. 2016 Consolidated Financial Statements (in thousands of dollars)

Maple Leaf’s depreciation policies for its property and equipment state that:

Property and equipment, with the exception of land, is recorded at cost less accumulated depreciation and any net accumulated impairment losses. Land is carried at cost and not depreciated. For qualifying assets, cost includes interest capitalized during the construction or development period. Construction-in-process assets are capitalized during construction and depreciation commences when the asset is available for use. Depreciation related to assets used in production is recorded in inventory and cost of goods sold. Depreciation related to non-production assets is recorded through selling, general, and administrative expense. Depreciation is calculated on a straight-line basis, aft er taking into account residual values, over the following expected useful lives of the assets:

Buildings, including other components ............................. 10-40 years

Machinery and equipment .................................................. 3-20 years

When parts of an item of property and equipment have different useful lives, those components are accounted for as separate items of property and equipment.

Required

a. Determine the average age percentage of Maple Leaf’s property and equipment. Compare this with the ratio determined for Dollarama (see Appendix A), and identify which company would be able to go longer without replacing its assets based on this ratio.

b. Given that Maple Leaf estimates that its machinery and equipment will have useful lives between 3 and 20 years, determine the annual straight-line depreciation rate that the company is using for its

machinery and equipment. c. Explain, in your own words, why Maple Leaf begins depreciation when the asset is available for use.

d. Explain, in your own words, what Maple Leaf means when it states that “depreciation related to assets used in production is recorded in inventory and cost of goods sold.”

e. If Maple Leaf’s net carrying amount for property and equipment was $1,085,275 thousand at its 2016 year end and $1,082,360 thousand at its 2015 year end, and its sales revenue was $3,331,812 thousand for the 2016 fiscal year, determine the company’s fixed asset turnover ratio. Compare this with the ratio determined for Dollarama in Appendix A and comment on which company did a better job of using its long-term assets to generate revenues.

Financial StatementsFinancial statements are the standardized formats to present the financial information related to a business or an organization for its users. Financial statements contain the historical information as well as current period’s financial... Asset Turnover

Asset turnover is sales divided by total assets. Important for comparison over time and to other companies of the same industry. This is a standard business ratio.

Step by Step Answer:

Understanding Financial Accounting

ISBN: 9781119406921

2nd Canadian Edition

Authors: Christopher D. Burnley