Megan Company (not a corporation) was careless about its financial records during its first year of operations,

Question:

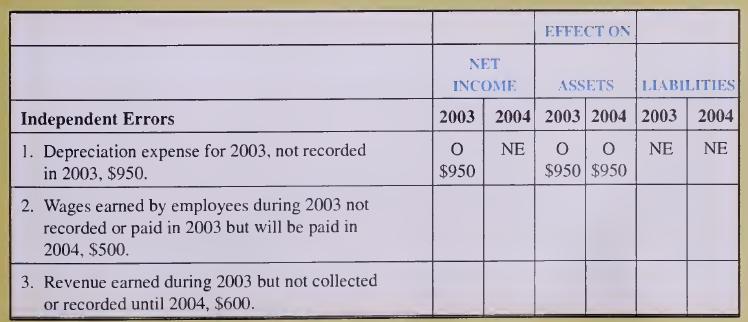

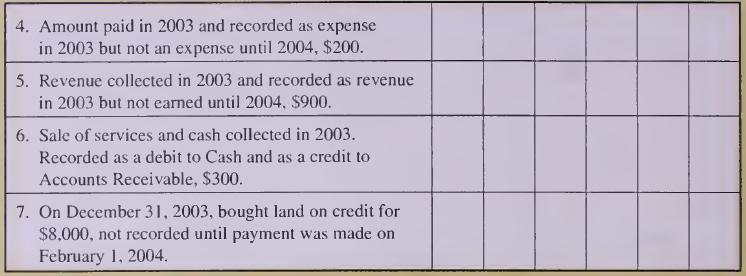

Megan Company (not a corporation) was careless about its financial records during its first year of operations, 2003. It is December 31, 2003, the end of the annual accounting period. An outside CPA examined the records and discovered numerous errors, all of which are described here. Assume that each error is independent of the others.

Required:

Analyze each error and indicate its effect on 2003 and 2004 income, assets, and liabilities if not corrected.

Do not assume any other errors. Use these codes to indicate the effect of each dollar amount:

O = overstated, U = understated, and NE = no effect. Write an explanation of your analysis of each transaction to support your response.

Following is a sample explanation of analysis of errors if not corrected, using the first error as an example: 1. Failure to record depreciation in 2003 caused depreciation expense to be too low; therefore, income was overstated by $950. Accumulated depreciation also is too low by $950, which causes assets to be overstated by $950 until the error is corrected.

Step by Step Answer: