Mildmay Ltd. (ML) is a public company that manufactures machine parts. In its most recent financial statements,

Question:

Mildmay Ltd.

(ML) is a public company that manufactures machine parts. In its most recent financial statements, ML wrote down $131,000,000 of its assets, which it will continue to use. The new president and CEO of ML announced that the writedowns were the result of competitive pressures and poor performance of the company in the last year.

They were reported separately in ML’s income statement as a “non-recurring” item—

ones that “result from transactions or events that aren’t expected to occur frequently over several years, or don’t typify normal business activities of the entity.” Mildmay doesn’t include the writeoff in its calculation of operating income.

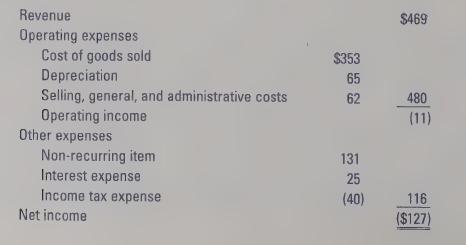

ML’s summarized income statement for the year ended December 31, 2014, is

(amounts in millions of dollars):

Required:

a. What would net income be in each of 2014 through 2017 had ML not written off the assets and continued to depreciate them? Assume that the operations of ML don’t change regardless of the accounting method used.

b. Why do you think the new management might have made the decision to write off the assets?

c. As an investor trying to evaluate the performance and predict future profitability, what problems do asset writedowns of this type create for you? Consider how the writeoff is reflected in the income statement and use the ML case as a basis for your discussion.

Step by Step Answer: