Monroeville Moving Corporation has been in operation since January 1. 2003. It is now December 31. 2003,

Question:

Monroeville Moving Corporation has been in operation since January 1. 2003. It is now December 31.

2003, the end of the annual accounting period. The company has not done well financially during the first year, although revenue has been fairly good. The three stockholders manage the company, but they have not given much attention to recordkeeping. In view of a serious cash shortage, they have applied to your bank for a $20,000 loan. You requested a complete set of financial statements. The following 2003 annual financial statements were prepared by a clerk and then were given to the bank.

After briefly reviewing the statements and "looking into the situation." you requested that the statements be redone (with some expert help) to "incorporate depreciation, accruals, inventory counts, income taxes, and so on.'* As a result of a review of the records and supporting documents, the following additional information was developed:

a. The supplies of $6,000 shown on the balance sheet has not been adjusted for supplies used during 2003. A count of the supplies on hand on December 31. 2003. showed SI. 800.

b. The insurance premium paid in 2003 was for years 2003 and 2004. The total insurance premium was debited in full to Prepaid Insurance when paid in 2003 and no adjustment has been made.

c. The equipment cost S40.000 when purchased January 1. 2003. It had an estimated annual depreciation of S8.000. No depreciation has been recorded for 2003.

d. Unpaid (and unrecorded) salaries at December 31. 2003. amounted to S2.200.

e. At December 31. 2003. transportation revenue collected in advance amounted to S7.000. This amount was credited in full to Transportation Revenue when the cash was collected earlier during 2003.

/ Income tax expense was S3.650 (the tax rate is 25 percent i.

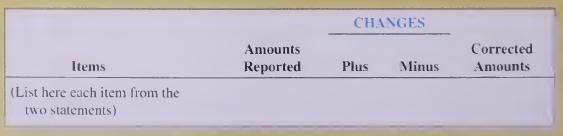

Required: 1. Record the six adjusting entries required on December 31. 2003. based on the preceding additional information. 2. Recast the preceding statements after taking into account the adjusting entries. You do not need to use classifications on the statements. Sussested form for the solution: 3. Omission of the adjusting entries caused:

3. Omission of the adjusting entries caused:

a Net income to be overstated or understated (select one) h\ $_

/'. Total assets on the balance sheet to be overstated or understated (select one) b\ $_ 4. For both of the unadjusted and adjusted balances, calculate these ratios for the company:

(a) earnings per share and

(b) net profit margin. Explain the causes of the differences and the impact of the changes on financial analysis. 5. Write a letter to the company explaining the results of the adjustments, your analysis, and your decision regarding the loan.

Step by Step Answer: