Question:

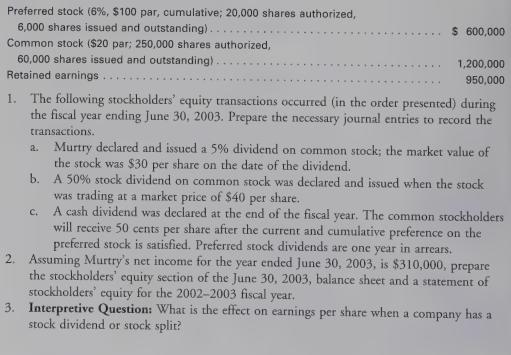

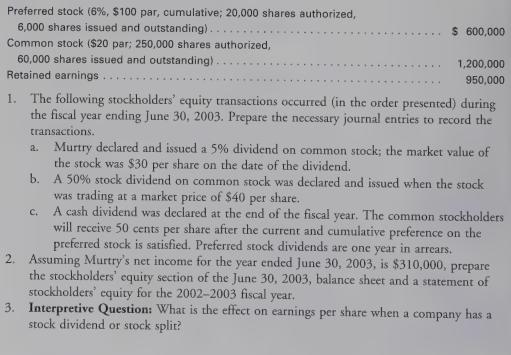

Murtry, Inc., reported the following stockholders’ equity balances in its June 30, 2002, balance sheet:

Transcribed Image Text:

Preferred stock (6%, $100 par, cumulative; 20,000 shares authorized, 6,000 shares issued and outstanding). Common stock ($20 par; 250,000 shares authorized, 60,000 shares issued and outstanding). Retained earnings. $ 600,000 1,200,000 950,000 1. The following stockholders' equity transactions occurred (in the order presented) during the fiscal 1 year ending June 30, 2003. Prepare the necessary journal entries to record the transactions. a. Murtry declared and issued a 5% dividend on common stock; the market value of the stock was $30 per share on the date of the dividend. b. A 50% stock dividend on common stock was declared and issued when the stock was trading at a market price of $40 per share. C. A cash dividend was declared at the end of the fiscal year. The common stockholders will receive 50 cents per share after the current and cumulative preference on the preferred stock is satisfied. Preferred stock dividends are one year in arrears. 2. Assuming Murtry's net income for the year ended June 30, 2003, is $310,000, prepare the stockholders' equity section of the June 30, 2003, balance sheet and a statement of stockholders' equity for the 2002-2003 fiscal year. 3. Interpretive Question: What is the effect on earnings per share when a company has a stock dividend or stock split?