(NPV; PI) Dallas Warehousing provides storage services for industrial firms. Usual items stored include records, inventory, and...

Question:

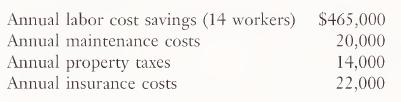

(NPV; PI) Dallas Warehousing provides storage services for industrial firms. Usual items stored include records, inventory, and waste items. The company is evaluating more efficient methods of moving inventory items into and out of storage areas. One vendor has proposed to sell Dallas Warehousing a conveyor system that would offer high-speed routing of inventory items. The required equipment would have an initial cost of $2,500,000 including installation. The vendor has indicated that the machinery would have an expected life of 7 years, with an estimated salvage value of $200,000. Below are estimates of the annual labor savings as well as the additional costs associated with the operation of the new equipment:

a. Assuming the company’s cost of capital is 9 percent, compute the NPV of the investment in the conveyor equipment (ignore tax).

b. Based on the NPV, should the company invest in the new machinery?

c. Compute the profitability index for this potential investment (ignore tax).

d. What other factors should the company consider in evaluating this investment?

Step by Step Answer: