(NPV; PI; IRR; Fisher rate) Howard Marley Investments, which has a weighted average cost of capital of...

Question:

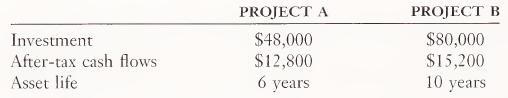

(NPV; PI; IRR; Fisher rate) Howard Marley Investments, which has a weighted average cost of capital of 12 percent, is evaluating two mutually exclusive projects (A and B), which have the following projections:

a. Determine the net present value, profitability index, and internal rate of re¬ turn for Projects A and B.

b. Using the answers to part

a, which is the more acceptable project? Why?

c. What is the Fisher rate for the two projects?

Fantastic news! We've Found the answer you've been seeking!

Step by Step Answer:

Related Book For

Question Posted: